标题:高盛提醒新兴市场投资者不要忘记正确的方向

需积分: 0 86 浏览量

更新于2024-01-26

收藏 1006KB PDF 举报

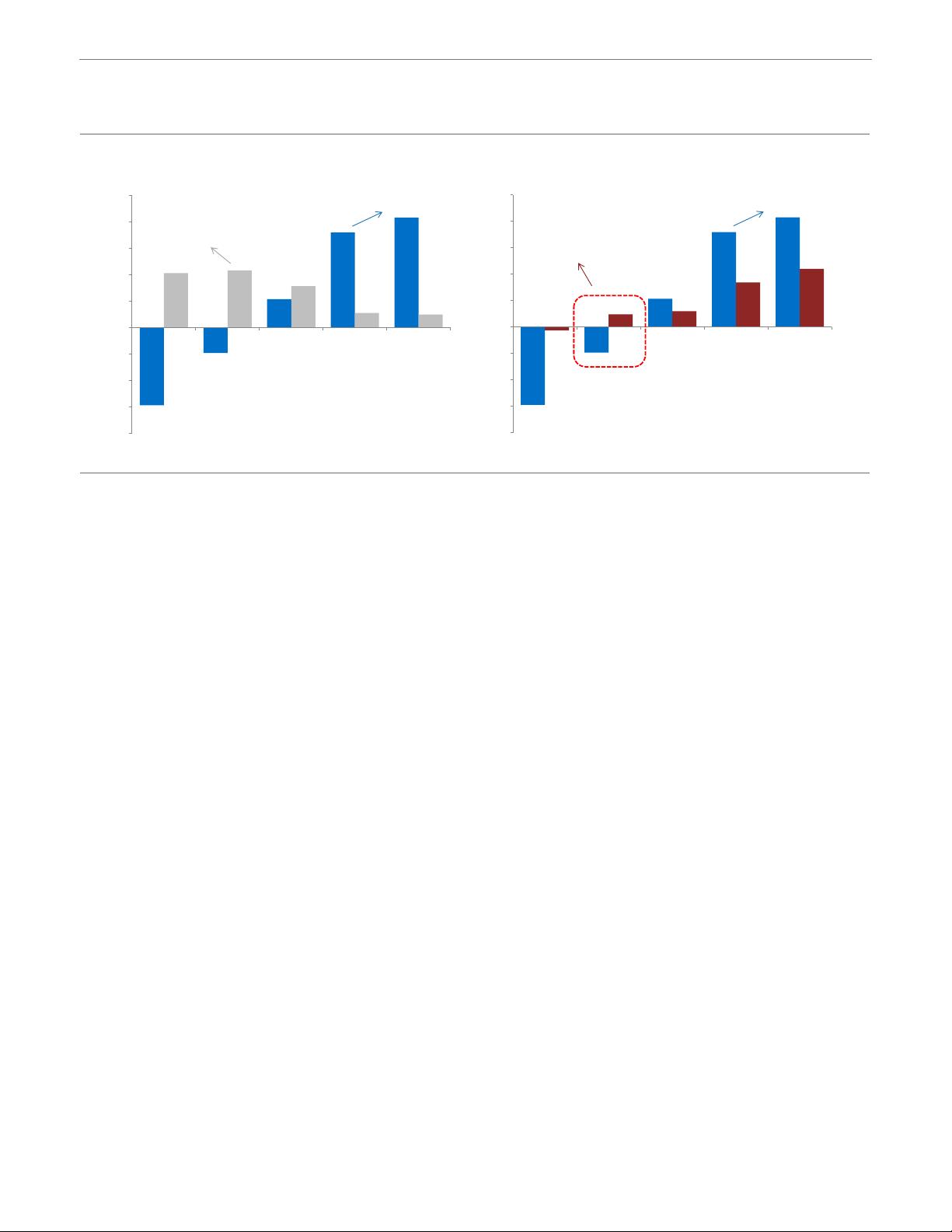

The document titled "高盛-新兴市场-宏观策略-不要“忘乎所以”:在新兴市场寻找正确的方向-0201-23页.pdf" discusses the concept of carry trades in emerging markets. The main focus is on EM FX (emerging market foreign exchange) carry trades, which have gained more attention due to the Federal Reserve's more accommodating stance and the weak US dollar environment in early 2019.

The term "carry trade" is defined as assets where the yield represents a significant portion of the total return, considering the mark-to-market risk. In this context, EM FX carry trades can be viewed as a "risk on" trade, as the yield is more favorable compared to the considerable carry in both US Treasuries and EM fixed income.

The document emphasizes the importance of understanding the factors that contribute to a good carry environment. Low volatility regimes are particularly favorable for carry trades, as they create opportunities for capturing yields. When volatility is low, the risks associated with carry trades are often reduced, making them more attractive to investors.

However, the document also notes that it is crucial not to overlook other factors beyond carry when evaluating emerging market investments. While carry trades may offer attractive yields, it is essential to assess the overall risk profile of the investment and consider other fundamental factors that might impact the performance of emerging market currencies and fixed income securities.

Overall, the document highlights the significance of identifying the correct direction in emerging markets and considering carry trades as part of a comprehensive investment strategy. It suggests that investors should not solely rely on carry as the primary determinant of their investment decisions but should also consider other macroeconomic factors and risk indicators in order to make informed investment choices in emerging markets.

2023-07-24 上传

2023-07-24 上传

2023-07-26 上传

2023-07-26 上传

2023-07-26 上传

2021-05-12 上传

qw_6918966011

- 粉丝: 26

- 资源: 6166

最新资源

- Java集合ArrayList实现字符串管理及效果展示

- 实现2D3D相机拾取射线的关键技术

- LiveLy-公寓管理门户:创新体验与技术实现

- 易语言打造的快捷禁止程序运行小工具

- Microgateway核心:实现配置和插件的主端口转发

- 掌握Java基本操作:增删查改入门代码详解

- Apache Tomcat 7.0.109 Windows版下载指南

- Qt实现文件系统浏览器界面设计与功能开发

- ReactJS新手实验:搭建与运行教程

- 探索生成艺术:几个月创意Processing实验

- Django框架下Cisco IOx平台实战开发案例源码解析

- 在Linux环境下配置Java版VTK开发环境

- 29街网上城市公司网站系统v1.0:企业建站全面解决方案

- WordPress CMB2插件的Suggest字段类型使用教程

- TCP协议实现的Java桌面聊天客户端应用

- ANR-WatchDog: 检测Android应用无响应并报告异常