EQUITIES

● AGRIBUSINESS

January 2019

How to play the sector

We prefer Buy rated OCI, CF Industries, Nutrien, and Mosaic in the fertilizer space; UPL

in crop chemicals. We think the earnings momentum of the sector coupled with cash

generation could possibly result in corporate actions including buyback announcements and

expansion plans.

Notably, Mosaic did not announce a buyback in 2018, unlike its peers, but may do so and/or

increase its dividend given the solid cash at disposal (we estimate 2019e FCF less dividends of

cUSD1bn). CF Industries completed share buybacks worth USD150m in 2018 and is planning

to complete the remaining USD350m authorized through 2020, although we expect the

company could achieve its target well in advance as management believes that CF shares

could offer more return currently than growth through expansion.

The scope and quantum of further buyback announcements by Nutrien (in addition to USD1.6bn

already completed in 2018) will likely depend upon its potential acquisition pipeline in Brazil. Notice

that Nutrien has an open Normal-Course Issuer Bid (NCIB) offer for 3% of shares (cUSD950m) by

February 2019, but also has USD1.5bn debt maturing in 1Q 2019, which the company plans to

repay through the USD4bn gross proceeds from the sale of SQM shares in 4Q 2018.

For OCI, we expect the ramp-up of new plants combined with historically low capex to generate

high free cash flow and thus drive rapid balance sheet de-leveraging and improvement in returns.

We estimate OCI can reduce group debt from USD4.3bn in 2018e to just USD2.5bn by end-2020e.

UPL’s share price has been affected by an overhang caused by the Arysta acquisition and

other issues including FX impact and US-China trade wars. We believe even part delivery on

synergies from the Arysta acquisition would have the twin impact of: 1) increasing earnings; and

2) expanding valuation multiples. There could be a positive surprise to earnings and multiples

from any good news related to the trade war or currency movements.

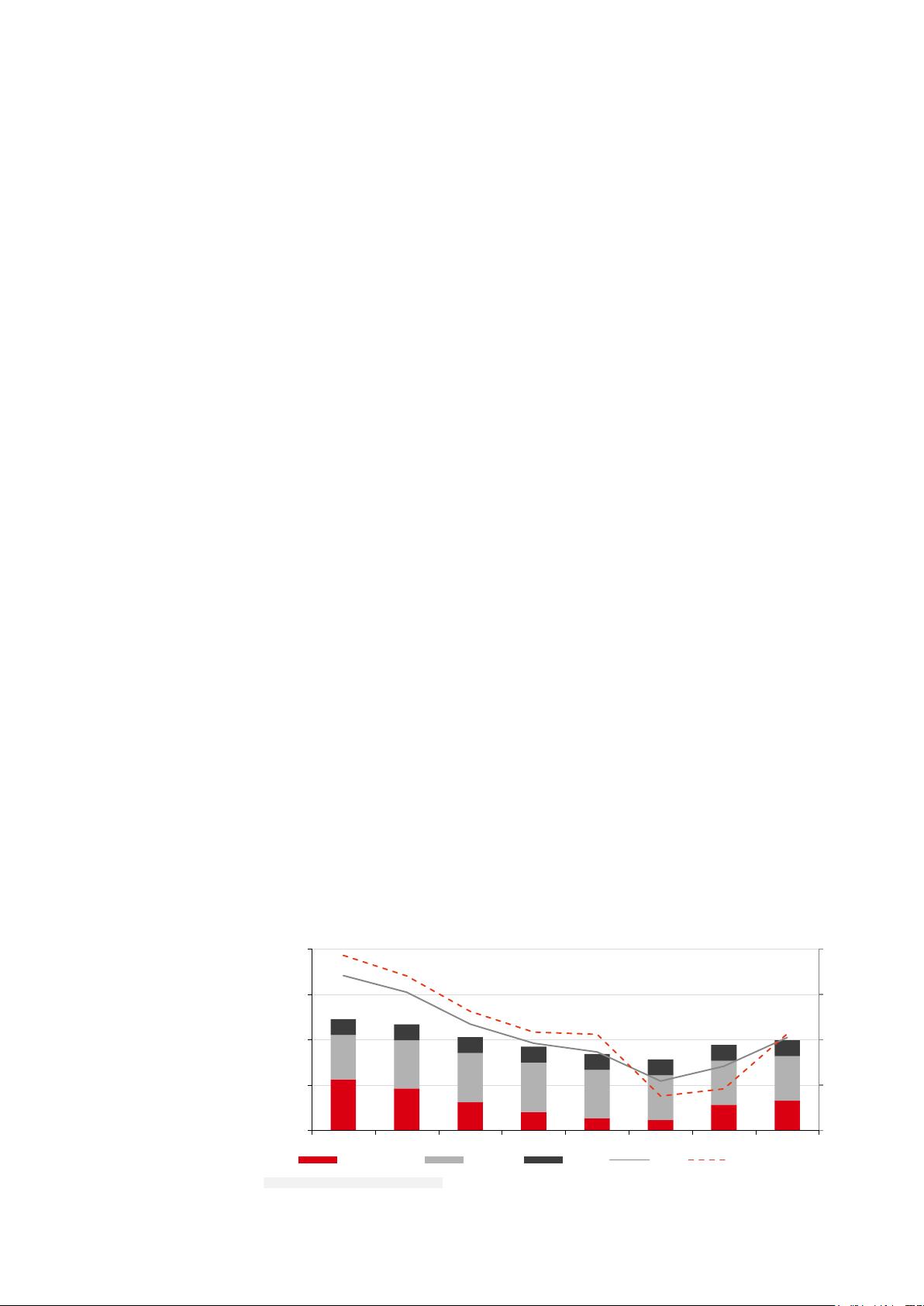

The fallout of a cold Fall

According to CRU reports, the cold Fall weather in the US severely affected 4Q 2018 fertilizer

application. The impact was likely more profound for retail and nitrogen businesses, implying

that NTR and CF will be the most affected in our coverage.

Weather-related disruptions are not uncommon in agriculture and usually result in a rebound in the

following application window. Hence, we expect a catch-up in 1H 2019, as was the case in 2Q

2018. In fact, the mix shift towards urea/UAN turned out to be positive for nitrogen sales at that time.

However, the key downside risk is the potential impact of the El Nino weather pattern on fertilizer

application and crop prices. The World Meteorological Organization (WMO) predicts a 75-80%

probability of El Nino conditions by February 2019, although this is not expected to be as severe

as the 2015-2016 event. In the event of El Nino causing a widespread drought, fertilizer

application could be impacted, resulting in downside risk to our earnings forecasts. We plan to

elaborate on the potential impact of El Nino in a separate report to be published in the future.

That said, we see 4Q 2018 earnings for US companies gravitating towards the lower end of

guidance. This coupled with investor cautiousness towards prolonged weather-related risks and

the impact of tariffs could result in some negative sentiment. Nonetheless, we see value in

fertilizer stocks, exacerbated by the recent decline in share prices.

Weather affects sentiment

more than earnings;

expected rebound in sales

will likely depend upon the

severity of El Nino