"基建回暖创投资机遇:建材行业投资策略解析_民生证券报告"

需积分: 0 78 浏览量

更新于2024-04-09

收藏 1.33MB PDF 举报

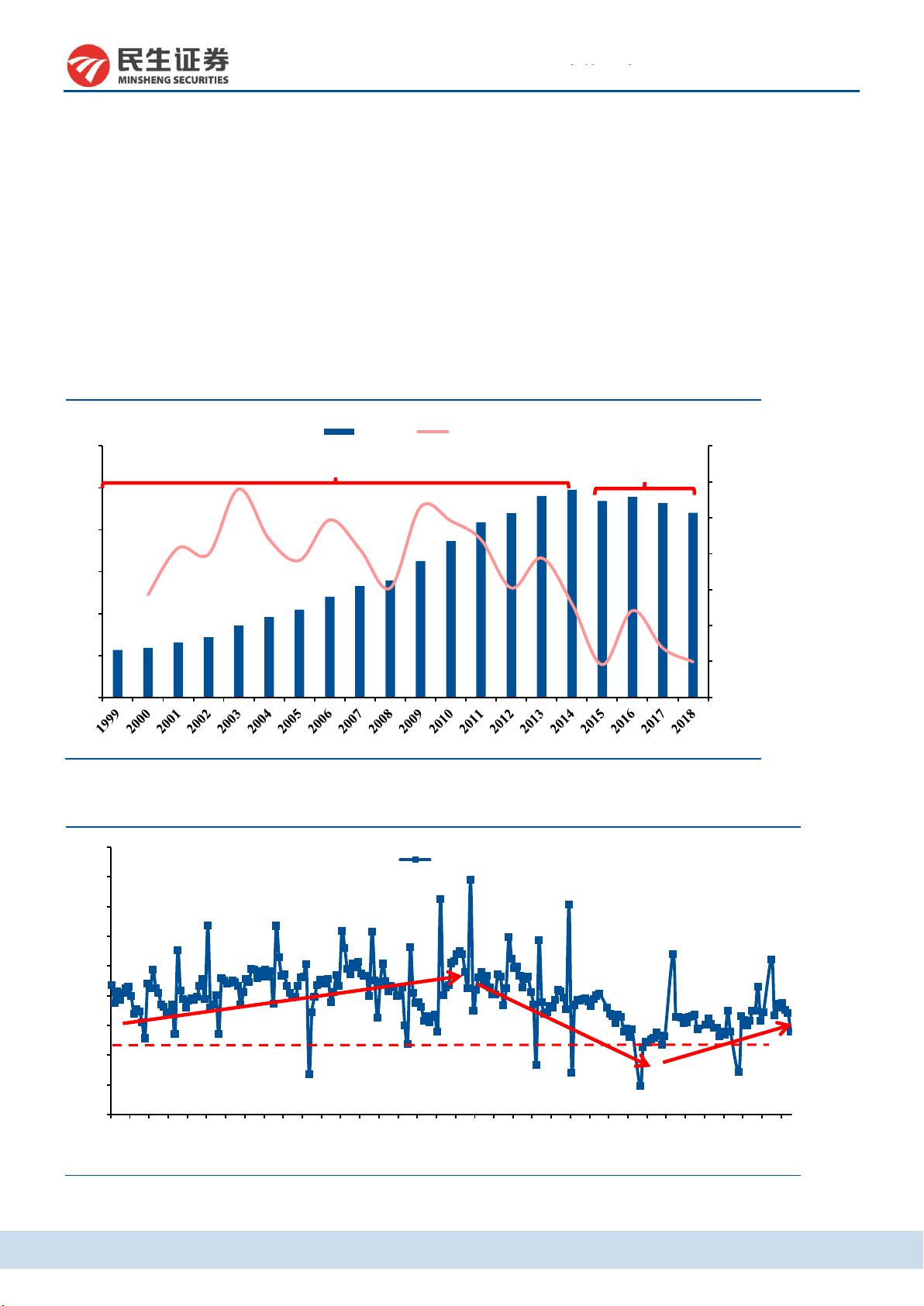

建材行业投资策略报告指出,错峰限产助力水泥持续景气,我国水泥需求量经历了快速增长和平台期两个阶段。水泥产量自2015年以来呈现出回暖趋势,而基建同比增速持续下滑,地产成为本轮需求回暖的主要因素。水泥价格受到错峰限产和地产扩张双重影响,进入平台期后稳定了价格;而在需求增长的情况下,水泥价格出现上涨。另一方面,玻璃行业自2015年以来进入了价和量的平台期。综合分析认为,当前时期建材行业投资机会主要来自于基建回暖带来的需求增长,投资者应把握错峰限产带来的利好,重点关注水泥和玻璃等相关板块的投资机会。Investment strategy report on building materials industry emphasizes the continued prosperity of cement with staggered production restrictions, and China's cement demand has experienced rapid growth and a platform phase. Cement production has shown a warming trend since 2015, while infrastructure investment growth has been declining, with real estate being the main driver of demand recovery in this round. Cement prices are influenced by both staggered production restrictions and real estate expansion, with a stable price in the platform phase from 2013 to 2015, and an increase in prices due to demand growth in the subsequent period. On the other hand, the glass industry has entered a platform period in terms of price and volume since 2015. Comprehensive analysis suggests that the current investment opportunities in the building materials industry mainly come from the demand growth brought by the recovery of infrastructure investment. Investors should seize the opportunities brought by staggered production restrictions and focus on investment opportunities in related sectors such as cement and glass.

2023-07-22 上传

2023-07-27 上传

2021-08-25 上传

2021-07-08 上传

2021-08-26 上传

2021-07-10 上传

wsnbb_2023

- 粉丝: 17

- 资源: 6002

最新资源

- 掌握Jive for Android SDK:示例应用的使用指南

- Python中的贝叶斯建模与概率编程指南

- 自动化NBA球员统计分析与电子邮件报告工具

- 下载安卓购物经理带源代码完整项目

- 图片压缩包中的内容解密

- C++基础教程视频-数据类型与运算符详解

- 探索Java中的曼德布罗图形绘制

- VTK9.3.0 64位SDK包发布,图像处理开发利器

- 自导向运载平台的行业设计方案解读

- 自定义 Datadog 代理检查:Python 实现与应用

- 基于Python实现的商品推荐系统源码与项目说明

- PMing繁体版字体下载,设计师必备素材

- 软件工程餐厅项目存储库:Java语言实践

- 康佳LED55R6000U电视机固件升级指南

- Sublime Text状态栏插件:ShowOpenFiles功能详解

- 一站式部署thinksns社交系统,小白轻松上手