"巴黎银行投资欧洲STOXX 50:股息监测器更新及重组风险评估"

下载需积分: 0 | PDF格式 | 1.29MB |

更新于2024-04-14

| 74 浏览量 | 举报

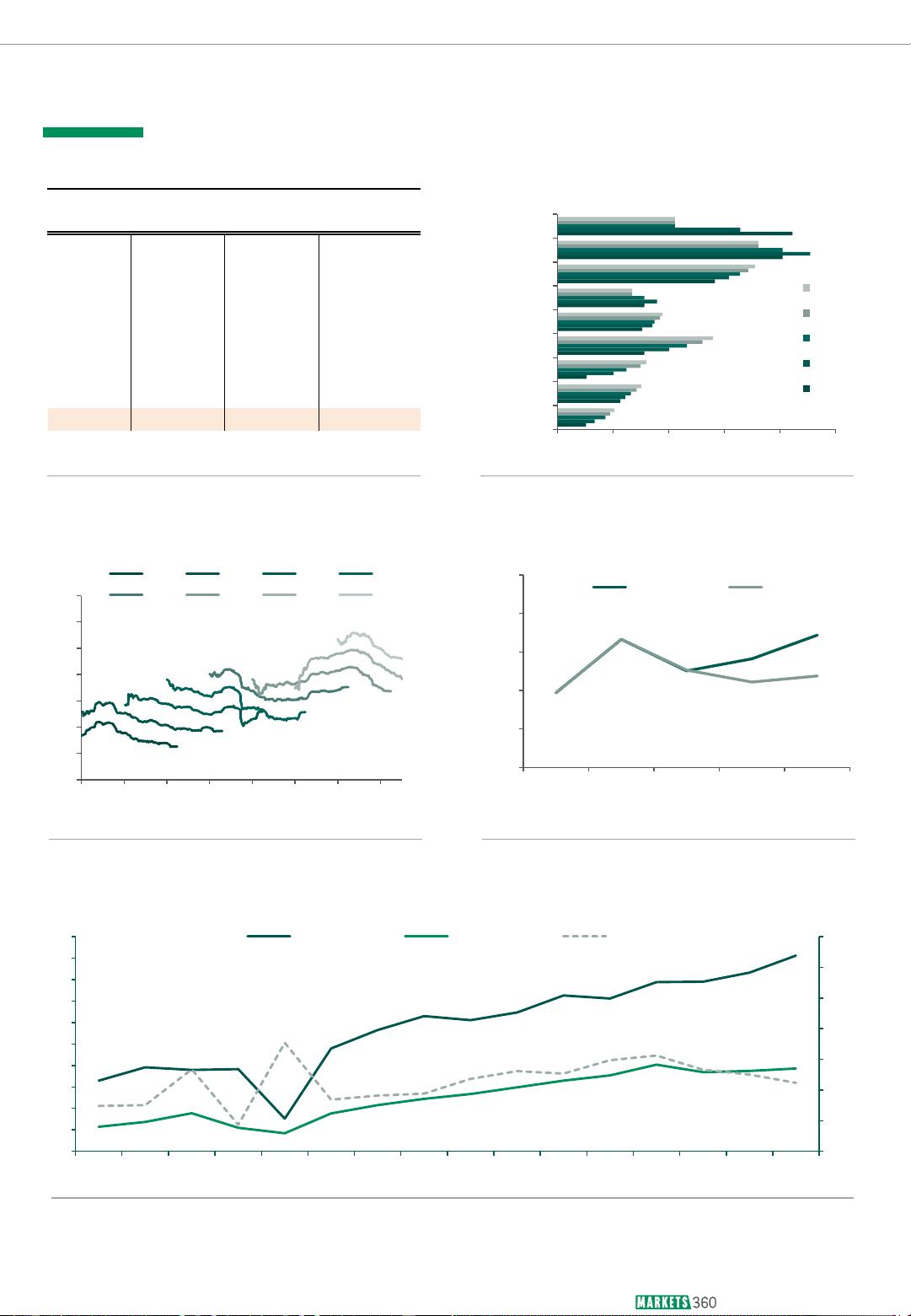

巴黎银行发布的投资策略报告指出,欧洲股市的投资环境发生了一些变化。其中,南非金融巨头Naspers推迟了其在阿姆斯特丹的新公司上市,这一举动消除了其在今年被纳入Euro STOXX 50指数(SX5E)的风险。而法国葡萄酒和烈酒集团Pernod Ricard仍然没有通过基于行业的初步过滤器,但已接近符合指数的条件。Unibail和Societe Generale距离当前自动删除阈值仅相差4.0%和2.7%。如果这两只股票在调整中被剔除,根据基准案例,我们估计该事件将对指数产生-1.8至4.2点的影响。这一消息是投资者们需要密切关注的重要信息,因为股市走势的变化可能会对他们的投资策略产生影响。Investment Strategy Report from BNP Paribas highlighted some changes in the investment environment in Europe. Naspers, the South African financial giant, has postponed the listing of its new company in Amsterdam, removing the risk of its inclusion in the Euro STOXX 50 index (SX5E) this year. Pernod Ricard, the French wine and spirits group, still does not pass the initial sector-based filter, but is close to meeting the index's criteria. Unibail and Societe Generale are only 4.0% and 2.7%, respectively, above the current automatic deletion threshold. If either or both of these stocks are removed in the reshuffle, the impact is estimated to range from -1.8 to 4.2 points according to the base case. This news is crucial for investors to keep a close eye on as changes in the stock market could affect their investment strategies.

相关推荐

2301_76429513

- 粉丝: 15

最新资源

- 人月神话:软件工程奠基之作

- Java 2 Platform 1.4学习指南:Sun Certified Programmer认证

- SCJP 1.4关键考点详解:数组操作与多维数组

- 精通GTK+开发:基于GTK+2.12的图形应用构建

- 软件项目经理实战指南:九阴真经

- MQC9.0管理员手册:全面掌握Quality Center项目管理与安全设置

- SWRL语言详解:融合OWL与RuleML的本体推导规则

- MyEclipse 6 Java 开发入门教程

- 2008文都概率讲义:经典教程+实例分析

- 新概念二册:私人对话与词汇解析

- 互联网搜索引擎:原理、技术与系统探索

- RedHat AS 3与Oracle9.2.0.4 Data Guard配置指南

- 配置TOMCAT5.0.28:环境变量与服务设置详解

- Visual Studio 2008与Windows Mobile 6开发详解

- Linux经典问题与快捷解答

- ASP.NET入门教程:连接ACCESS与SQL SERVER数据库