The rest of the paper is organized as follows: In Section 2,

we describe the roles of the PSPs and the SSP in the

spectrum trading and define the reward function for the

SUs as well as the risk function for OSA. We introduce

related concepts to band-mix selection including band-mix

selection rule, efficient OSA curves and the SSP’s utility

function in Section 3. We elaborate on the two proposed

risk metrics for OSA: the X loss and the expected X loss in

Section 4. With the discritized version of the expected X

loss, we illustrate the optimal band-mix selection of the SSP

for OSA in Section 5. Finally, we cond uct numerical

simulations and analyze the performance results in Sec-

tion 6, and draw the concluding remarks in Section 7.

2SYSTEM MODEL

2.1 Spectrum Market

We consider a spectrum market in cognitive radio networks

[16] with multiple PSPs operating on different spectrum

bands and a SSP who serves a group of SUs as shown in

Fig. 1a. The SUs can take opportunistic use of these licensed

spectrum bands when the primary services are not on, but

must evacuate from these bands immediately when

primary services become active. In addition, we assume

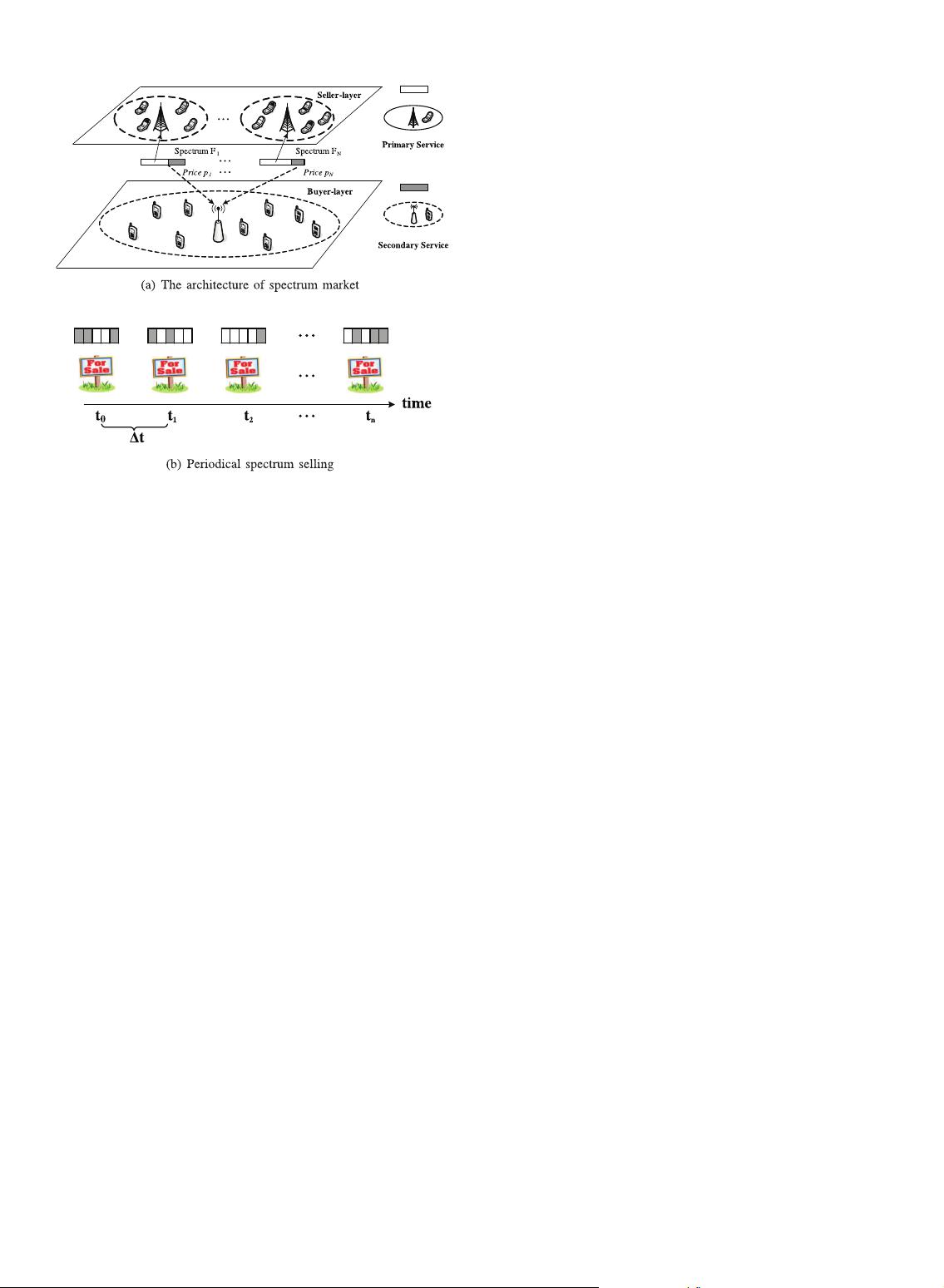

all the spectrum transactions take place at starting time of

each period

3

as shown in Fig. 1b, and the payment for

spectrum trading is nonrefundable.

In this case, PSPs will set reasonable prices for the

unoccupied bands considering the quality of the bands as

well as competition among the PSPs in the spectrum market

[13], [15], [16], and sell those bands periodically for

monetary gains. Correspondingly, if the SSP (e.g., the base

station (BS) or the access point (AP)) realizes there is not

enough radio resource for the traffic demands of its SUs,

the SSP will play the role of trading agent for the SUs [6].

Specifically, the SSP will try to select a mix of currently

vacant licensed bands, buy those bands from the PSPs,

charge the SUs with the prices set by PSPs and share the

bands purchased among multiple SUs in a time-division

multiple access (TDMA) manner.

2.2 SSP’s Revenue and Risk Function

Assume there are n available spectrum bands owned by

different PSPs with identical bandwidth, which is equal to

1, within the sensing range of the SSP. Considering the

unpredictable activities of primary services, the uncertain

spectrum supply of different bands for a given period is

represented by ss ¼ðs

1

;s

2

; ...;s

n

Þ, where s

i

is a random

variable

4

within the domain of ½0; 1. Suppose, the total

traffic demand from the SUs is 1, and the proportional

composition of the band-mix that the SSP picks up is

!! ¼ð!

1

;!

2

; ...;!

n

Þ, !! 2W, where

P

n

i¼1

!

i

¼ 1. Then, the

total spectrum resources the SSP can obtain is

P

n

i¼1

s

i

!

i

,

and the expected reward for the SSP can be written as

ð!!Þ¼r

X

n

i¼1

IE ½s

i

!

i

; ð1Þ

where r is a constant, representing the SSP’s reward for

satisfying one unit of traffic.

5

Correspondingly, the risk

function of the SSP can be expressed as

‘ð!!; ssÞ¼pp

T

!! rss

T

!!; ð2Þ

where pp ¼ðp

1

;p

2

; ...;p

n

Þ is the charging price vector set by

the PSPs for OSA per period, and p

i

is a constant during a

spectrum trading period. Note that p

i

p

j

,ifIE ðs

i

ÞIE ðs

j

Þ.

Since r is a fixed number and ss is a random vector, the risk

for OSA depends on both the statistical characteristics of ss

and the SSP’s selection of bands belonging to the PSPs.

3PRIMARY CONCEPTS FOR BAND-M IX SELECTION

3.1 Band-Mix Selection Principle

Intuitively, the SSP is able to maximize his revenue by

pouring all the traffic of SUs over a particular band with the

maximal expected reward. However, the risk of using that

band may be quite high. A rational or risk-averse SSP is not

likely to gamble all the traffic on one band since the reward

may be extraordinarily low considering the activities of

primary services.

Therefore, the expected reward should not be the only

criterion in choosing the spectrum bands to access; instead,

the risk of the reward must be considered by the SSP. It is

reasonable to believe that if any two band-mixes have the

same expected reward, the SSP will prefer the one having

the smaller risk for OSA, and if any two band-mixes have

the same risk, the SSP will prefer the one having the greater

expected reward. So, the criterion for band-mix selection is

as the follows.

PAN ET AL.: THE X LOSS: BAND-MIX SELECTION FOR OPPORTUNISTIC SPECTRUM ACCESSING WITH UNCERTAIN SPECTRUM SUPPLY... 2135

Fig. 1. System model for spectrum trading.

3. The selling/buying period 4t should not be too long (e.g., days,

months, or years) to make dynamic spectrum access infeasible, and it

should not be too short (e.g., milliseconds or seconds) to incur over-

whelming overhead in spectrum trading. The typical duration is minutes or

hours as shown in [32]. In the rest of paper, we assume that all the spectrum

transactions are of fixed duration, so that the time parameter is not included

in our formulation.

4. Here, s

i

can be interpreted as unoccupie d time or unoccupied

bandwidth by primary services for band i during one time period.

5. With the assumption that r is fixed, ð!!Þ can also be interpreted as the

expected traffic demands that the SSP is able to support.