1.4 Cost and Trends in Cost

15

before it becomes price, and the computer designer should understand how a de-

sign decision will affect the potential selling price. For example, changing cost

by $1000 may change price by $3000 to $4000. Without understanding the rela-

tionship of cost to price the computer designer may not understand the impact on

price of adding, deleting, or replacing components. The relationship between

price and volume can increase the impact of changes in cost, especially at the low

end of the market. Typically, fewer computers are sold as the price increases. Fur-

thermore, as volume decreases, costs rise, leading to further increases in price.

Thus, small changes in cost can have a larger than obvious impact. The relation-

ship between cost and price is a complex one with entire books written on the

subject. The purpose of this section is to give you a simple introduction to what

factors determine price and typical ranges for these factors.

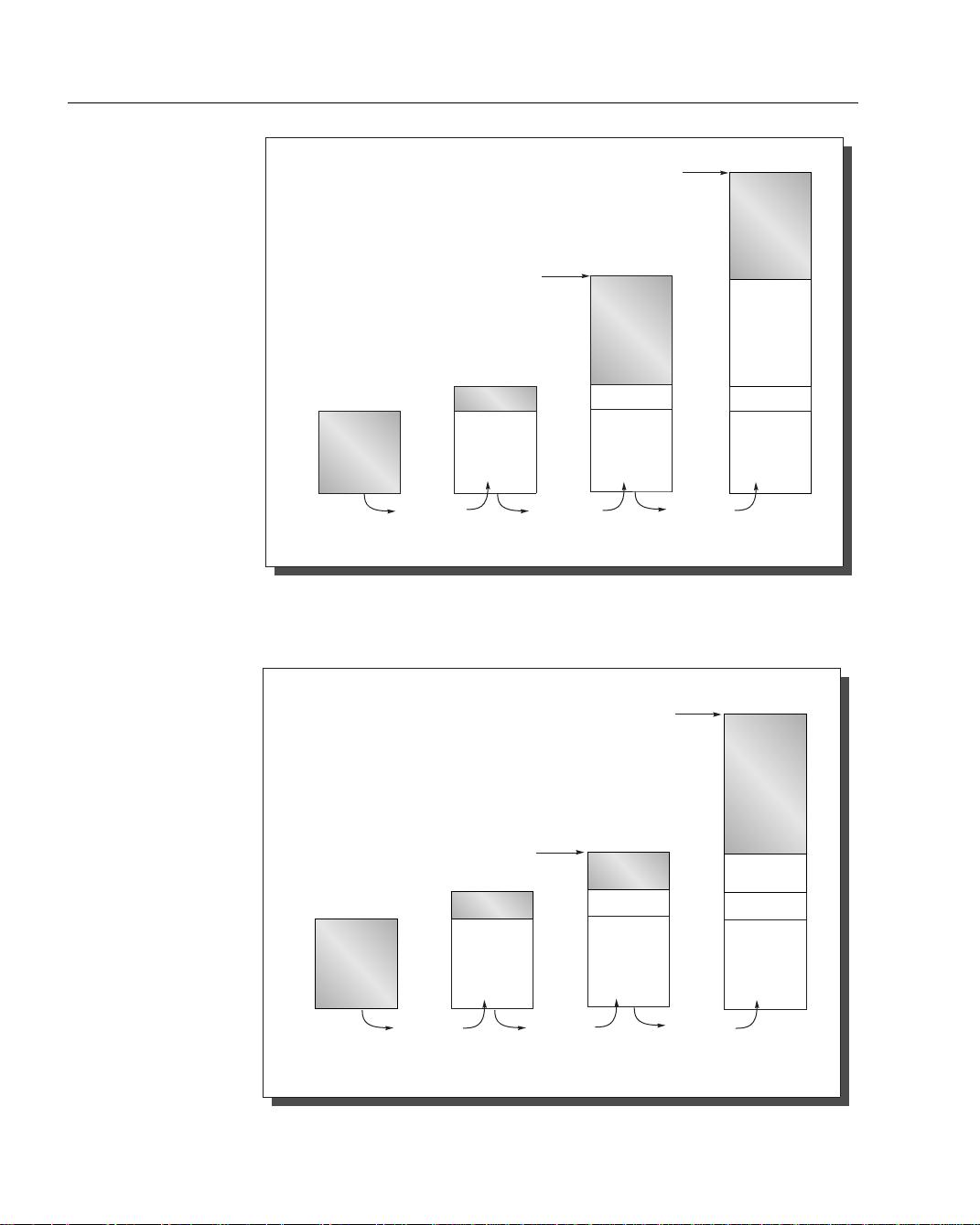

The categories that make up price can be shown either as a tax on cost or as a

percentage of the price. We will look at the information both ways. These differ-

ences between price and cost also depend on where in the computer marketplace

a company is selling. To show these differences, Figures 1.7 and 1.8 on page 16

show how the difference between cost of materials and list price is decomposed,

with the price increasing from left to right as we add each type of overhead.

Direct costs

refer to the costs directly related to making a product. These in-

clude labor costs, purchasing components, scrap (the leftover from yield), and

warranty, which covers the costs of systems that fail at the customer’s site during

the warranty period. Direct cost typically adds 20% to 40% to component cost.

Service or maintenance costs are not included because the customer typically

pays those costs, although a warranty allowance may be included here or in gross

margin, discussed next.

The next addition is called the

gross margin

, the company’s overhead that can-

not be billed directly to one product. This can be thought of as indirect cost. It in-

cludes the company’s research and development (R&D), marketing, sales,

manufacturing equipment maintenance, building rental, cost of financing, pretax

profits, and taxes. When the component costs are added to the direct cost and

gross margin, we reach the

average selling price—ASP in the language of

MBAs—the money that comes directly to the company for each product sold.

The gross margin is typically 20% to 55% of the average selling price, depending

on the uniqueness of the product. Manufacturers of low-end PCs generally have

lower gross margins for several reasons. First, their R&D expenses are lower.

Second, their cost of sales is lower, since they use indirect distribution (by mail,

phone order, or retail store) rather than salespeople. Third, because their products

are less unique, competition is more intense, thus forcing lower prices and often

lower profits, which in turn lead to a lower gross margin.

List price and average selling price are not the same. One reason for this is that

companies offer volume discounts, lowering the average selling price. Also, if the

product is to be sold in retail stores, as personal computers are, stores want to

keep 40% to 50% of the list price for themselves. Thus, depending on the distri-

bution system, the average selling price is typically 50% to 75% of the list price.