「厚尾分布下的随机区间突破策略」-金融工程报告详解传统策略优化

需积分: 0 42 浏览量

更新于2024-04-02

收藏 875KB PDF 举报

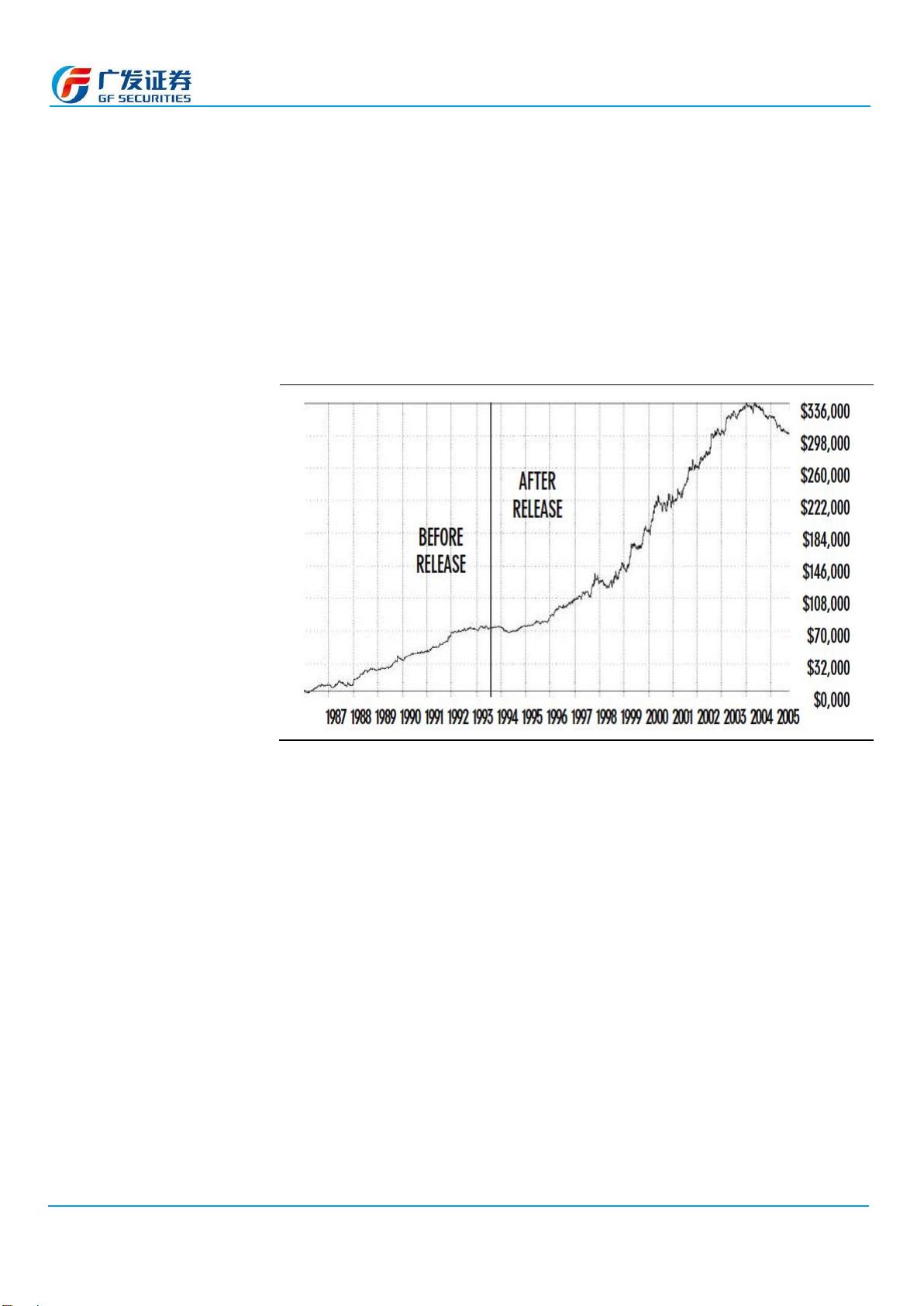

The report "Thick-tailed Distribution Random Interval Breakthrough Strategy" published by Guangfa Securities in August 2014 introduces a unique trading strategy in the financial market. Traditionally, the Opening Range Breakout strategy is widely used, where traders enter long positions when the stock index futures break above a certain price level the next trading day, and short positions when they fall below a certain price level.

In calculating the breakout price and the downward breakout price, the report suggests using the Opening Range Breakout method as a reference. This method involves adding a certain range width to the opening price to get the breakout price, and subtracting the range width to get the downward breakout price. The range width can be optimized by historical market data to improve the strategy's effectiveness.

The report also highlights the equivalence between the Opening Range Breakout strategy and a long position in a wide strangle options combination. It notes that the inclusion of symmetric profit-taking and stop-loss levels in the Opening Range Breakout strategy renders it ineffective. Through mathematical analysis, the report proves that the profits from the breakout strategy are equivalent to the profits from the wide strangle options combination minus the portion of profits lost when the option hits the stop-loss price but returns to the exercise price by the end of the period.

Overall, the report provides valuable insights for traders and investors looking to explore alternative trading strategies in the financial market. By understanding the principles of thick-tailed distribution and random interval breakthrough strategies, market participants can better identify risks and discover value in their trading decisions. It is essential to study and analyze the report's findings, bearing in mind the disclaimer provided at the end of the document to make informed investment choices and capitalize on market opportunities effectively.

2021-05-12 上传

2022-08-04 上传

2022-08-04 上传

2024-01-26 上传

2023-03-26 上传

2023-09-01 上传

2023-12-18 上传

2024-06-07 上传

2023-10-19 上传

明儿去打球

- 粉丝: 17

- 资源: 327

最新资源

- 磁性吸附笔筒设计创新,行业文档精选

- Java Swing实现的俄罗斯方块游戏代码分享

- 骨折生长的二维与三维模型比较分析

- 水彩花卉与羽毛无缝背景矢量素材

- 设计一种高效的袋料分离装置

- 探索4.20图包.zip的奥秘

- RabbitMQ 3.7.x延时消息交换插件安装与操作指南

- 解决NLTK下载停用词失败的问题

- 多系统平台的并行处理技术研究

- Jekyll项目实战:网页设计作业的入门练习

- discord.js v13按钮分页包实现教程与应用

- SpringBoot与Uniapp结合开发短视频APP实战教程

- Tensorflow学习笔记深度解析:人工智能实践指南

- 无服务器部署管理器:防止错误部署AWS帐户

- 医疗图标矢量素材合集:扁平风格16图标(PNG/EPS/PSD)

- 人工智能基础课程汇报PPT模板下载