August 7, 2017

Goldman Sachs Global Investment Research 16

Private capital now has a seat at the table, and technology is the key enabler

Although the regulatory shifts might introduce changes to some disruptors’ business

models, we note that private capital has uncharacteristically high participation in the

FinTech infrastructure ownership, and it will therefore likely have a bigger voice in

influencing future policy directions. Most of China’s existing basic infrastructures (bridges

and roads/electricity grids), regardless of industries, were built and owned by SOEs or

government agencies, and hence eventually the government. But we point out that a few

big players in the FinTech industry have not only built a sizeable user base for the next

generation of financial infrastructure, but also started to own them. Indeed, some

innovators have come a long way making themselves more indispensable with a real

technological advantage. We believe this could have implications on future industry

structure/directions, technological standards as well as customer ownerships.

One of these early examples is Wanglian, China’s newly established centralized clearing

network for all third-party payments. The largest shareholders besides the Central Bank

PBOC and the State Administration of Foreign Exchange (SAFE) are Ant Financial (9.61%)

and Tencent (9.61%). This is in stark contrast with China’s only card network UnionPay,

which was built and still owned by PBOC and SOE Banks, and hence eventually the

government.

Private participation in infrastructure of this scale is almost unprecedented in other

industries in China. We think this is because – in order to regulate in the digital age – the

regulators need to work closely with disruptors (who are often private companies instead

of SOEs), as that is where the technology know-how and processing power lies.

We emphasize that regulating the FinTech industry is a dynamic balancing act and we

might see regulations constantly evolving through trial and error. Owing to the nascent

nature of the business model and the public-private collaboration, it would be difficult to

surmise the policy directions. Thus, we believe it is important to track the development of

how a few early initiatives evolves (such as the payment clearing house), as it could have

deep implications for regulating the rest of the FinTech industry.

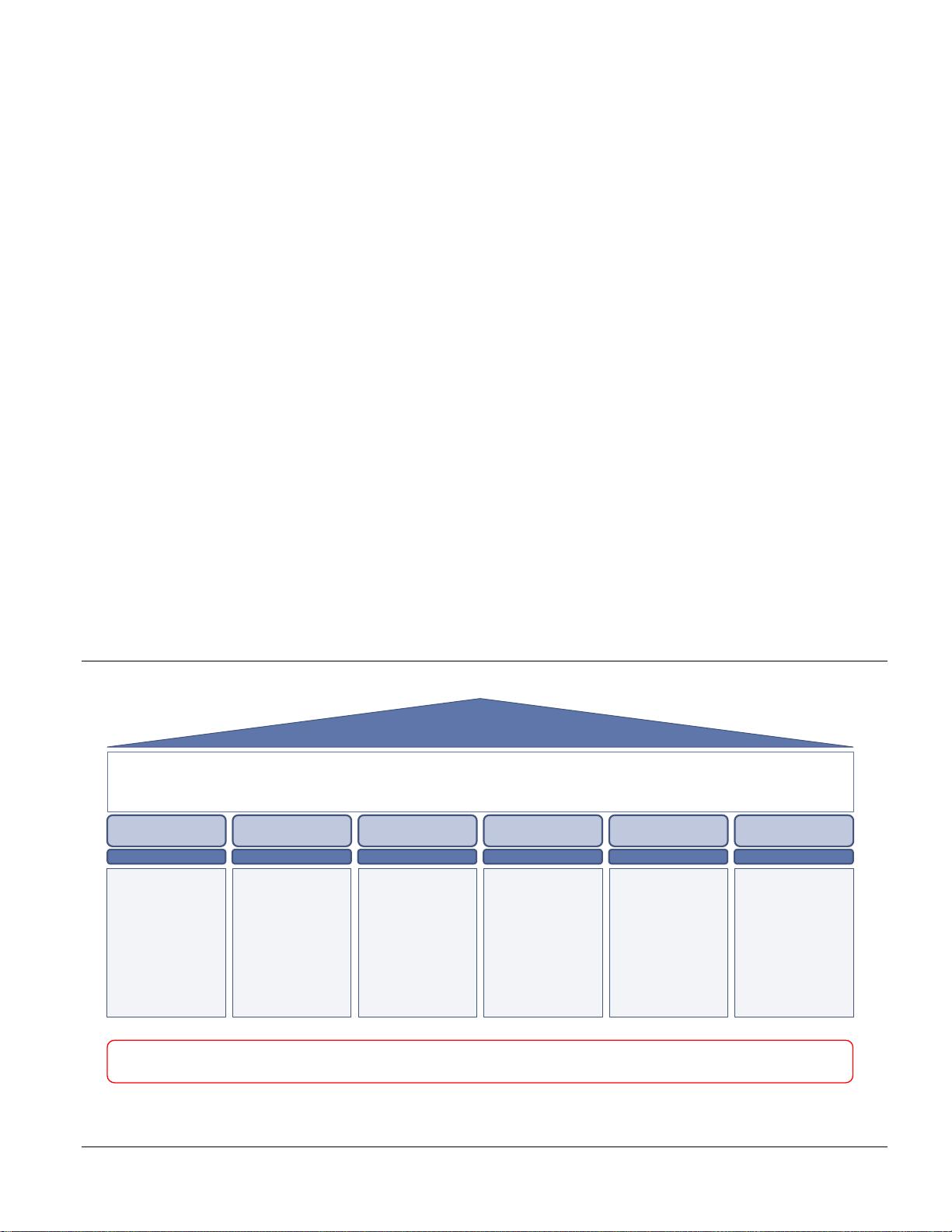

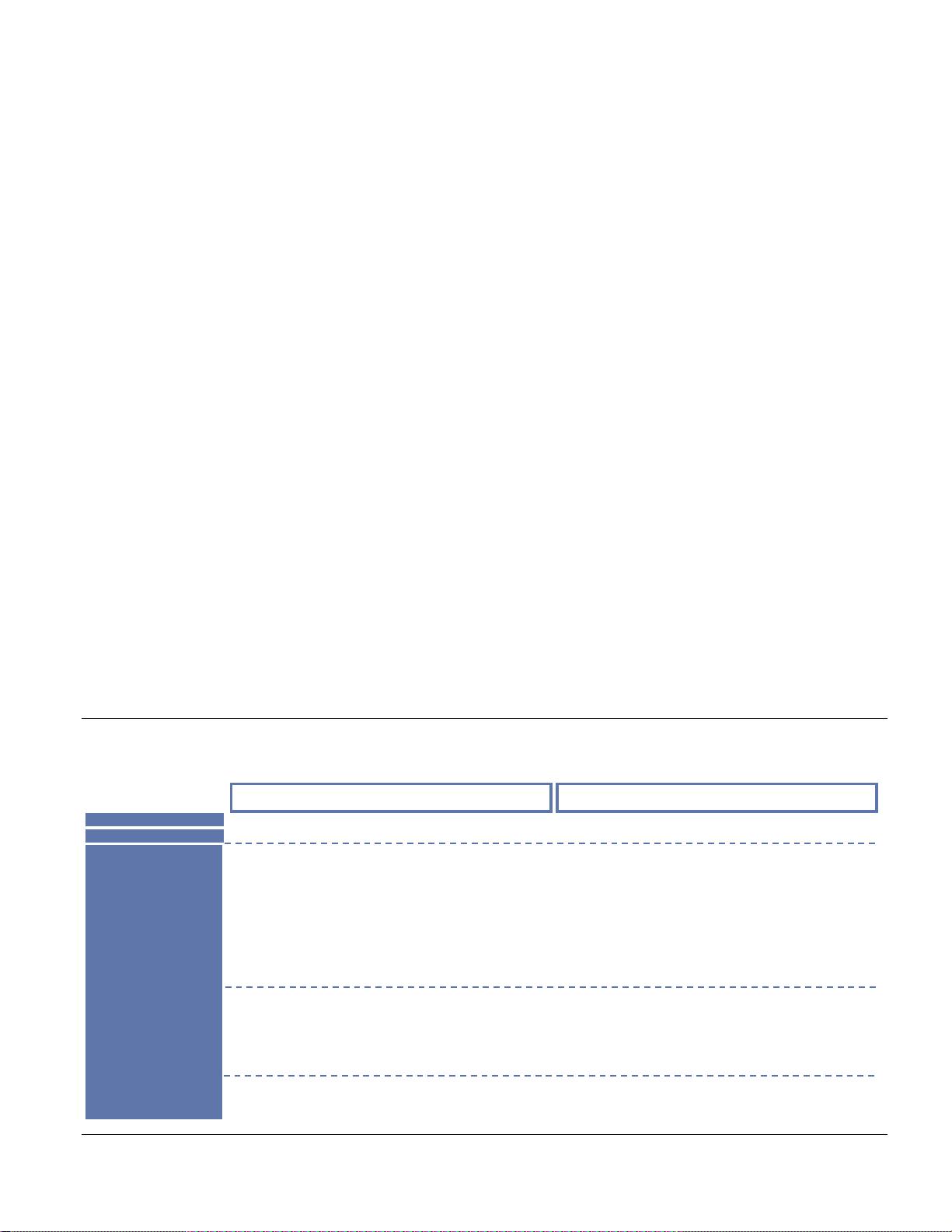

Exhibit 12: Private companies are playing a bigger role in China’s FinTech infrastructure for the first time.

Alipay and Tenpay are the largest shareholders of China’s only clearing house for all online payments, besides PBOC and SAFE.

This compares to China’s only card network, UnionPay, built and owned by PBOC and SOE banks. Data as of 2017.

Source: Company data, Sina, Goldman Sachs Global Investment Research

China UnionPay Wanglian (sole clearing house for all online payment)

152 45

2.93 2

25% by 6 main shareholders:

China Banknote Printing and Minting (4.86%)

China Construction Bank (4.78%) China National Clearing Center (12%)

Industrial and Commercial Bank of China (3.84%) Wutongshu Investment Platform (10%)

Agricultural Bank of China (3.84%) Shanghai Clearing House (3%)

Bank of China (3.84%) Shanghai Gold Exchange (3%)

Bank of Communications (3.84%)

China Banknote Printing and Minting (3%)

National Association of Financial Market Institutional

Investors (3%)

Joint-stock commercial banks such as: 63% by 38 non-bank payment companies such as:

China Merchants Bank, Shanghai Pudong Development

Bank, Postal Saving Bank of China, China CITIC Bank,

China Guangfa Bank, Everbright Bank, Ping An Bank,

Hua Xia Bank, Industrial Bank, Minsheng Bank, etc.

Alipay (9.61%)

Tenpay (9.61%)

JD Pay (4.71%)

35 other payment companies (<3% each)

Municipal commercial banks, credit cooperatives and non-

bank institutions

Payment and Clearing Association of China (3%,

representing other small & medium-sized payment

companies)

34% by 6 national institutions, including affiliates of

PBOC and State Administration of Foreign Exchange

Number of shareholders

Capital (Rmb bn)

Main shareholders

Future of Finance: The Rise of China FinTech