"JP摩根美股策略分析:FLT与WEX股票策略-129-22页"

需积分: 0 121 浏览量

更新于2023-12-29

收藏 433KB PDF 举报

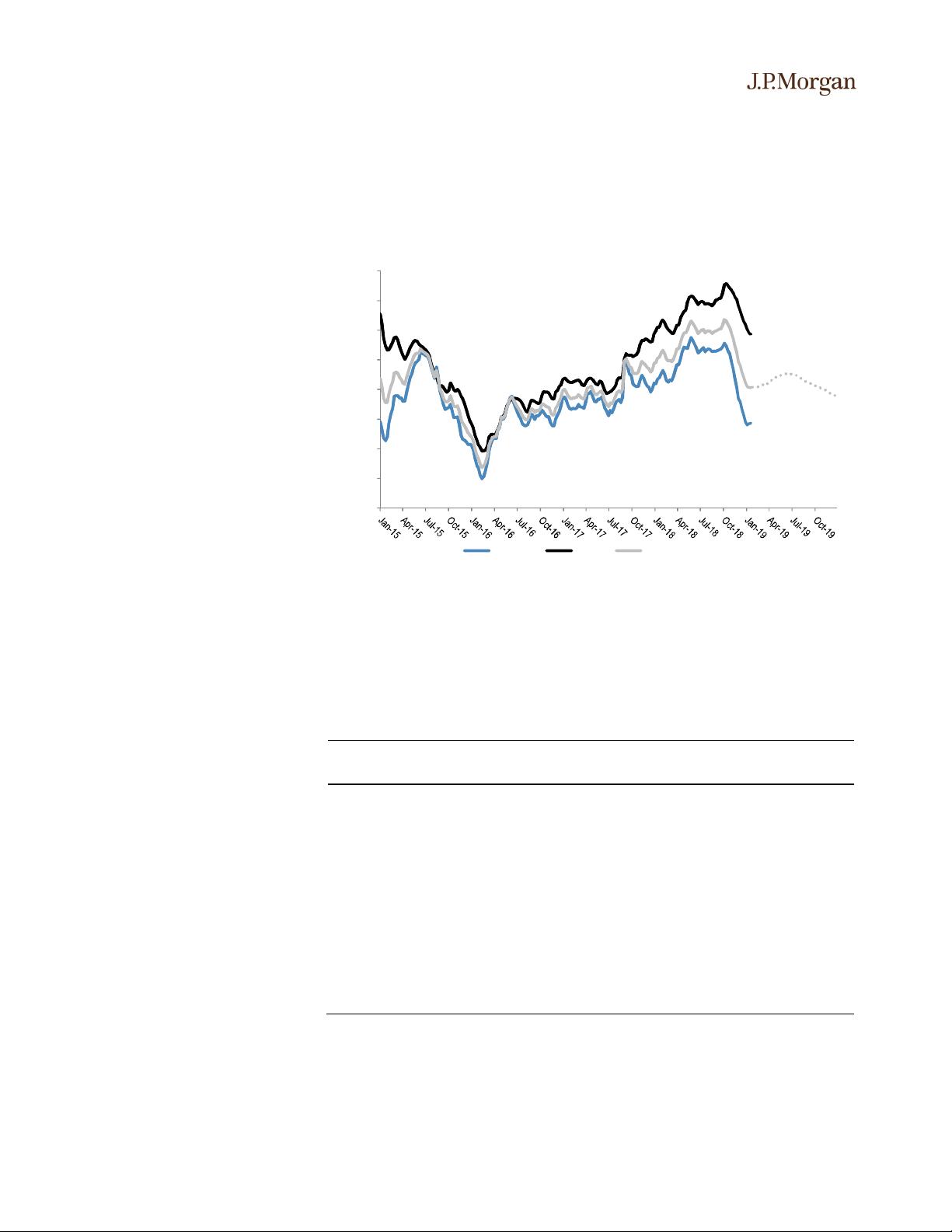

and transportation management company, FL Technologies (FLT) has been given an "Overweight" rating by JP Morgan in their recent stock strategy analysis. With a current price of $198.50 as of January 28th, 2019, JP Morgan has set a price target of $226.00 for FLT by December 2019. The analysis points out that the 4Q/FY19 Fuel Card Preview suggests that fuel weighs on FLT's FY19 outlook, but despite this, JP Morgan prefers FLT over its competitor WEX.

On the other hand, WEX, a payments and processors company, has received a "Neutral" rating from JP Morgan in the same stock strategy analysis. With a current price of $160.43 as of January 28th, 2019, JP Morgan has set a price target of $183.00 for WEX by December 2019. The analysis discusses the competitive positioning of WEX in the market, but still, JP Morgan has a neutral stance on WEX compared to FLT.

This analysis can be found in the document titled "JP Morgan - US Stocks - Stock Strategy - FLT and WEX Stock Strategy Analysis - 129-22 pages.pdf" available on www.jpmorganmarkets.com as of January 29th, 2019.

In summary, JP Morgan's analysis of FLT and WEX stocks in the North America Equity Research has rated FLT as "Overweight" with a price target of $226.00 by December 2019, while WEX has received a "Neutral" rating with a price target of $183.00 for the same period. The analysis discusses the factors affecting the companies' outlook and provides insights into why JP Morgan prefers FLT over WEX despite the challenges faced by FLT in the fuel card market. This information is crucial for investors looking to make informed decisions about investing in these companies.

2023-07-29 上传

2021-04-08 上传

2022-09-14 上传

2023-07-24 上传

2021-07-30 上传

2021-05-08 上传

2301_76429513

- 粉丝: 15

- 资源: 6728

最新资源

- 模因生成

- s60-mymoney-2-feidee-money:将我的财务中导出的数据迁移到随手记

- webassembly.zip

- pglp_4.1

- XX公司人力资源薪酬专员行为标准

- asp+ACCESS酒店房间预约系统设计(源代码+论文).rar

- BuildingSoftwareSystemHomeWorks:CENG431初步选举课程作业

- web-development:该存储库包含自学习的全栈开发资料

- cordova-plugin-mediachooser

- danielreguero:我的个人博客文章网站

- MySVGs:只是我的svg文件

- heightEcharts资源.zip

- Ecasepaper:纸箱

- [论坛社区]IPB(Invision Power Board) v2.1.2 简体中文修正版_ipb.rar

- 支付app转账页面ui .sketch素材下载

- rubberduck