没有合适的资源?快使用搜索试试~ 我知道了~

首页论文研究 - 使用机器学习算法预测信用卡交易欺诈

论文研究 - 使用机器学习算法预测信用卡交易欺诈

需积分: 0 18 下载量 155 浏览量

更新于2023-05-15

评论 4

收藏 956KB PDF 举报

信用卡欺诈是金融机构的一个广泛问题,涉及使用支付卡进行的盗窃和欺诈。 在本文中,我们探索了线性和非线性统计模型以及机器学习模型在真实信用卡交易数据上的应用。 建立的模型是受监督的欺诈模型,试图识别哪些交易最有可能是欺诈性的。 我们讨论了数据探索,数据清理,变量创建,特征选择,模型算法和结果的过程。 探索和比较了五个不同的监督模型,包括逻辑回归,神经网络,随机森林,增强树和支持向量机。 增强树模型显示了针对此特定数据集的最佳欺诈检测结果(FDR = 49.83%)。 所得模型可以在信用卡欺诈检测系统中使用。 可以在相关业务领域(如保险和电信)中执行类似的模型开发过程,以避免或检测欺诈行为。

资源详情

资源评论

资源推荐

Journal of Intelligent Learning Systems and Applications, 2019, 11, 33-63

http://www.scirp.org/journal/jilsa

ISSN Online: 2150-8410

ISSN Print: 2150-8402

DOI:

10.4236/jilsa.2019.113003 Aug. 14, 2019 33 Journal of Intelligent Learning Systems and Applications

Predicting Credit Card Transaction Fraud Using

Machine Learning Algorithms

Jiaxin Gao

1

, Zirui Zhou

2*

, Jiangshan Ai

3

, Bingxin Xia

4

, Stephen Coggeshall

5

1

Hebei University of Economics and Business, Shijiazhuang, China

2

China University of Political Science and Law, Beijing, China

3

Wuhan Maple Leaf International School (High School), Wuhan, China

4

Wuhan Jinde Education Consulting, Co., Ltd., Wuhan, China

5

University of Southern California, Los Angeles, USA

Abstract

Credit card fraud is a wide-

ranging issue for financial institutions, involving

theft and fraud committed using a payment card. In this paper,

we explore

the application of linear and nonlinear statistical modeling and machine

learning models on real credit card transaction da

ta. The models built are

supervised fraud models that attempt to identify which transactions are

most likely fraudulent. We discuss the processes of data exploration,

data

cleaning, variable creation, feature selection, model algorithms, and results.

Five different supervised models are explored and compared including lo-

gistic regression, neural networks, random forest,

boosted tree and support

vector machines. The boosted tree model shows the best fraud detection re-

sult (FDR = 49.83%) for this particular data set. The

resulting model can be

utilized in a credit card fraud detection system. A similar

model development

process can be performed in related business domains such as insurance and

telecommunications, to avoid or detect fraudulent activity.

Keywords

Credit Card Fraud, Machine Learning Algorithms, Logistic Regression,

Neural Networks, Random Forest, Boosted Tree, Support Vector Machines

1. Introduction

Credit card fraud remains an important issue for theft and fraud committed us-

ing a payment card, such as a credit card or debit card. To combat this many

fraud detection algorithms are widely used in industry [1] [2] [3] [4]. Card fraud

can happen with the theft of the physical card as well as with the compromise of

How to cite this paper:

Gao, J.X.,

Zhou,

Z

.R., Ai, J.S., Xia, B.X. and Coggeshall, S.

(201

9)

Predicting Credit Card Transaction

Fraud Using Machine Learning Algo

rithms

.

Journal of Intelligent Learning Systems and

Applications

,

11

, 33-63.

https://doi.org/10.4236/jilsa.2019.113003

Received:

April 6, 2019

Accepted:

August 11, 2019

Published:

August 14, 2019

Copyright © 201

9 by author(s) and

Scientific

Research Publishing Inc.

This work is licensed under the Creative

Commons Attribution

-NonCommercial

International License (

CC BY-NC 4.0).

http://creativecommons.org/licenses/by

-nc/4.0/

Open Access

J. X. Gao et al.

DOI:

10.4236/jilsa.2019.113003 34 Journal of Intelligent Learning Systems and Applications

the card, including skimming, breach, account takeover, that would otherwise

look like a legitimate transaction. According to the Global Payments Report

2015 [5], the credit card is the highest-used payment method globally in 2014

compared to other methods such as an e-wallet and Bank Transfer. Along with

the rise of credit card usage, the number of fraud cases has also been steadily in-

creasing [6]. The rise in credit card fraud has a large impact on the financial in-

dustry. The global credit card fraud in 2015 reached a staggering USD 21.84 bil-

lion [7].

Financial institutions today typically develop custom fraud detection systems

targeted to their own portfolios [8]. The data mining and machine learning

techniques are vastly embraced to analyze patterns of normal and unusual beha-

vior as well as individual transactions in order to flag likely fraud. Given the re-

ality, the best cost-effective option is to tease out possible evidence of fraud from

the available data using statistical algorithms [9]. Supervised models trained on

labeled data examine all previous labeled transactions to mathematically deter-

mine how a typical fraudulent transaction looks and assigns a fraud probability

score to each transaction [10]. Among the supervised algorithms typically used,

the neural network is popular, and support vector machines (SVMs) have been

applied, as well as decision trees and other models [3] [9] [11]-[21]. However,

little attention has been devoted in the literature to some comparison of all the

common algorithms, particularly using real data sets.

In this paper, we explore the application of various linear and nonlinear statis-

tical modeling and machine learning models on credit card transaction data. The

models built are supervised fraud models that attempt to identify which transac-

tions are most likely fraudulent.

2. Description of Data

The data available for this research project are a collection of credit card transac-

tions from a government agency located in Tennessee, U.S.A. The particular

agency is not known.

The data consist of 96,753 credit card transactions during the year 2010, with

1059 labeled as fraud. The file contains the fields:

• Record: A unique identifier for each data record. This field also represents

the time order;

• Cardnum: The account number for the transactions (we note that they are

Mastercard transaction since the account numbers begin with the digits 54);

• Date: The date of the transaction. Month, day and year only (no time of day);

• Merchnum: A typically 12-digit merchant identification number;

• Merch Description: A brief text description field of the merchant, typically

around 20 characters;

• Merch State: The state of the address for the merchant;

• Merch Zip: The zip code of the merchant;

• Transtype: A code denoting the type of transaction;

J. X. Gao et al.

DOI:

10.4236/jilsa.2019.113003 35 Journal of Intelligent Learning Systems and Applications

• Amount: The dollar amount of the transaction;

• Fraud: A label for the transaction to indicate whether or not it was a fraudu-

lent transaction.

Table 1 shows summary information about all the fields. Only the Amount

field is a numeric type field; the other fields are all categorical or text. The statis-

tical magnitudes in the table were calculated with the outliers eliminated. Three

fields have some missing values: Merchnum, Merch state, and Merch zip. It was

noticed that the number of unique values of the Merch state field is 227, which is

unexpected because the U.S. has only 50 states. Some of the values in this field

might be from other countries, such as Canada and/or Mexico.

Below we show some further information about the data.

Figure 1 shows the number of transactions each month. We noticed the gen-

eral upward trend through September, followed by a sharp drop in October. The

monthly transactions are fewer in the last quarter of the year compared with

other quarters. This is due to the government fiscal year which starts on October

1, and people tend to be more cautious with their money in the first few months

of the new fiscal year.

Figure 2 shows the top 10 of the most frequently traded merchant descrip-

tions. The total transaction frequency of the top 15 categories is 13,256, which is

about 13.7% of the records. The top 200 categories account for 41% of the total

records. In

Table 1, we see that there are 13,126 kinds of merchants by this

Merch description field, and 48.6% of the merchant descriptions only occurred

once.

Figure 3 depicts the top 10 of the most frequently observed merchant states.

Table 1. Summary description of the data set.

Fields name Type

Records that

have a value

Percent

populated

Mode # Unique values

Record Index 96,753 100% 96,753

Cardnum Categorical 96,753 100% 5142148452 1645

Date Time 96,753 100% 2/28/10 365

Merchnum

Categorical

93,378 96.5% 930090121224 13,091

Merch description 96,753 100% GSA-FSS-ADV 13,126

Merch state 95,558 98.8% TN 227

Merch zip 92,097 95.2% 38118 4567

Transtype 96,753 100% P 4

Amount Numeric 96,753 100% 3.62

Mean 395.33*

34,909

Max 30372.46*

Min 0.01

Std 814.74*

Fraud Categorical 96,753 100% 0 2

*Statistical magnitude without outliers.

J. X. Gao et al.

DOI:

10.4236/jilsa.2019.113003 37 Journal of Intelligent Learning Systems and Applications

The most frequent state is TN which is about 12.6% of the whole transaction

frequency, and is not surprising because that is where the facility is located. The

total number of transactions in the top 15 states is 71,647, which is about 75% of

the entire records. From

Table 1 we see that there are 227 different states in the

data. And we note that 168 of the state’s field values are numbers rather than

letters.

3. Data Cleaning

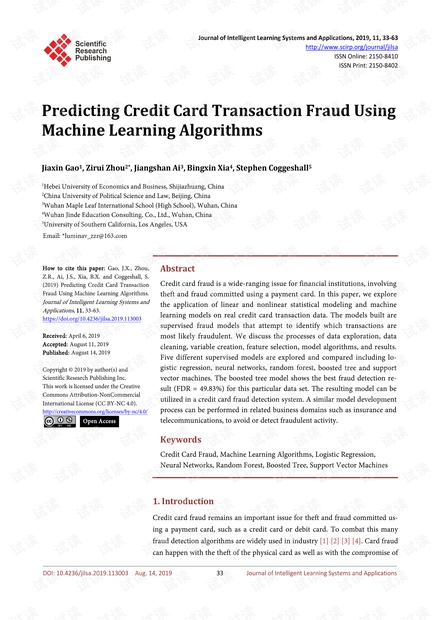

When we examine the field Amount, shown in the box plot distribution Figure

4, we see that there is one large outlier with the Amount value recorded as over 3

million dollars. After thoroughly checking that particular record, which is not

labeled as fraud, we discover that it is an unusual but known transaction in

Mexican pesos from a particular Mexican organization, and we thus exclude it

from further analysis.

Table 2 shows the information about the fields with missing values. All of

these three fields have a strong relationship with the field Merch description, but

the same Merch description may also correspond to different values in the three

above fields. These three fields also have a strong relationship with each other, so

the mode of each field is used to fill in the missing fields.

Figure 4. Box plot distribution of the Amount field.

Table 2. Fields with missing values.

Field

Records with missing values

Percentage (%) Mode

Merchnum 3357 3.49 930090121224

Merch state 1195 1.24 TN

Merch zip 4565 4.81 38118

0 1.0e+06

2.0e+06

3.0e+06

Amount

剩余30页未读,继续阅读

weixin_38641339

- 粉丝: 12

- 资源: 927

上传资源 快速赚钱

我的内容管理

收起

我的内容管理

收起

我的资源

快来上传第一个资源

我的资源

快来上传第一个资源

我的收益 登录查看自己的收益

我的收益 登录查看自己的收益 我的积分

登录查看自己的积分

我的积分

登录查看自己的积分

我的C币

登录后查看C币余额

我的C币

登录后查看C币余额

我的收藏

我的收藏  我的下载

我的下载  下载帮助

下载帮助

会员权益专享

最新资源

- zigbee-cluster-library-specification

- JSBSim Reference Manual

- c++校园超市商品信息管理系统课程设计说明书(含源代码) (2).pdf

- 建筑供配电系统相关课件.pptx

- 企业管理规章制度及管理模式.doc

- vb打开摄像头.doc

- 云计算-可信计算中认证协议改进方案.pdf

- [详细完整版]单片机编程4.ppt

- c语言常用算法.pdf

- c++经典程序代码大全.pdf

- 单片机数字时钟资料.doc

- 11项目管理前沿1.0.pptx

- 基于ssm的“魅力”繁峙宣传网站的设计与实现论文.doc

- 智慧交通综合解决方案.pptx

- 建筑防潮设计-PowerPointPresentati.pptx

- SPC统计过程控制程序.pptx

资源上传下载、课程学习等过程中有任何疑问或建议,欢迎提出宝贵意见哦~我们会及时处理!

点击此处反馈

安全验证

文档复制为VIP权益,开通VIP直接复制

信息提交成功

信息提交成功

评论0