"2021特斯拉影响力报告:呼吁ESG评估方法革新"

版权申诉

43 浏览量

更新于2024-03-04

收藏 15.5MB PDF 举报

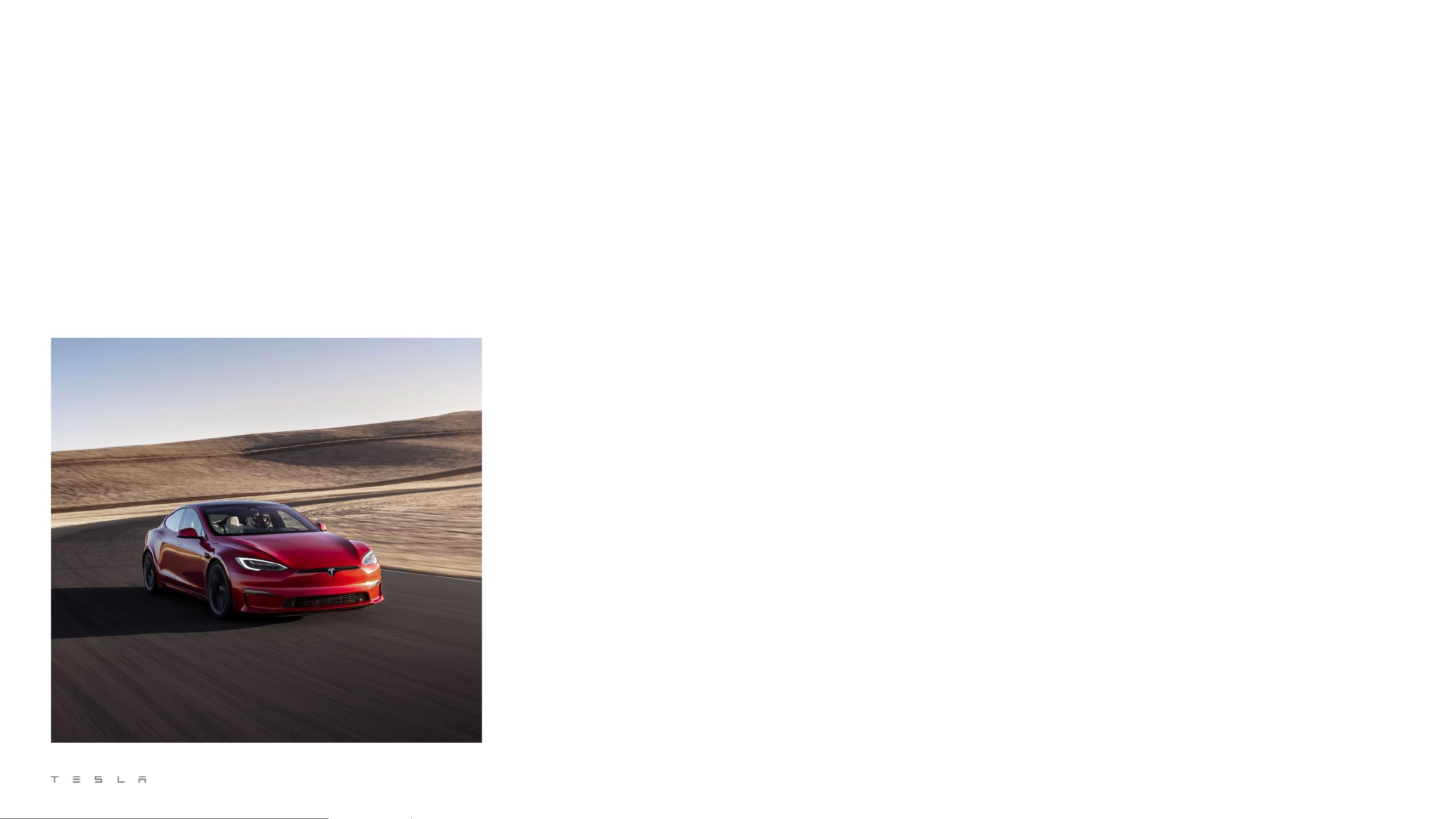

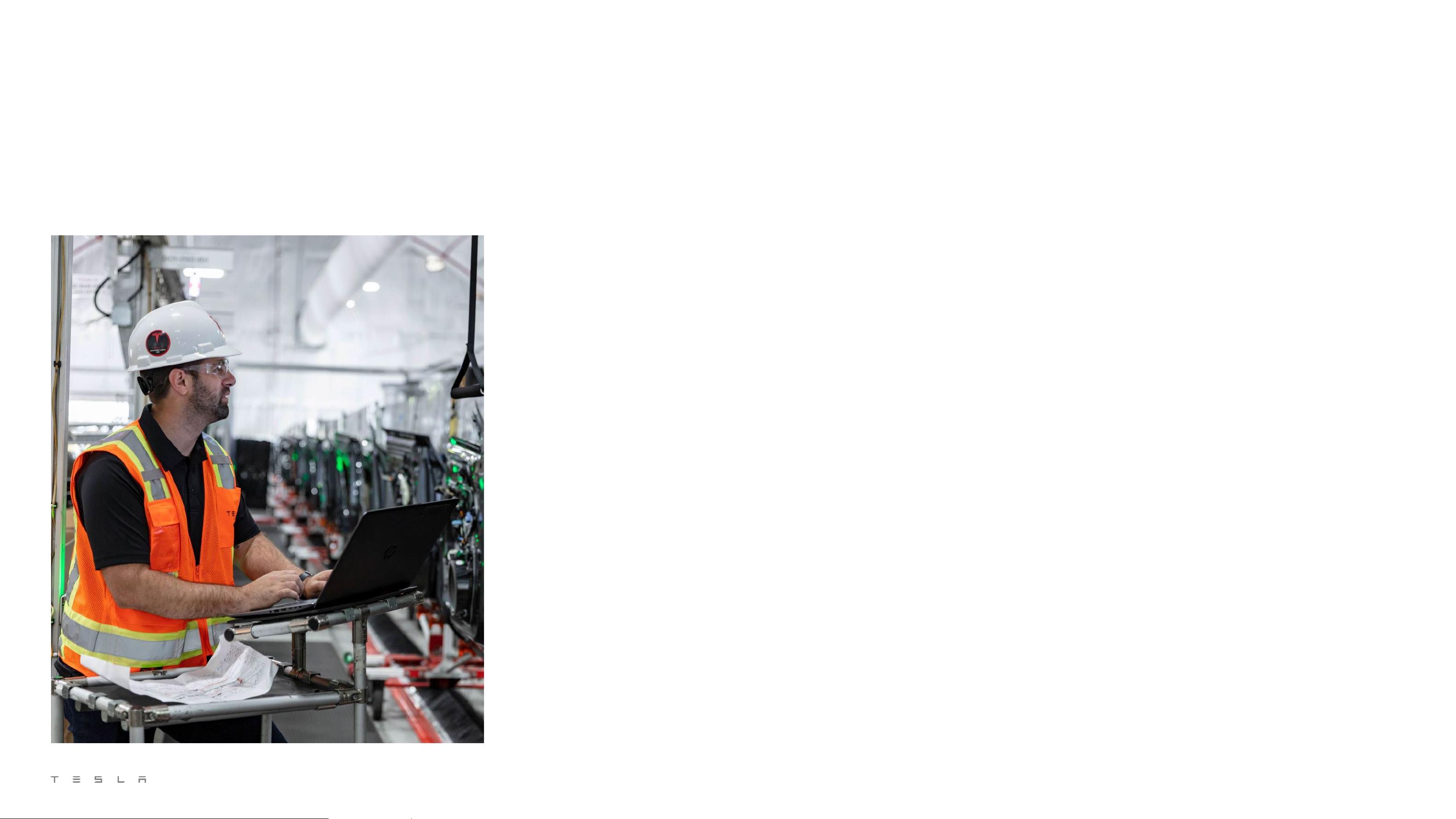

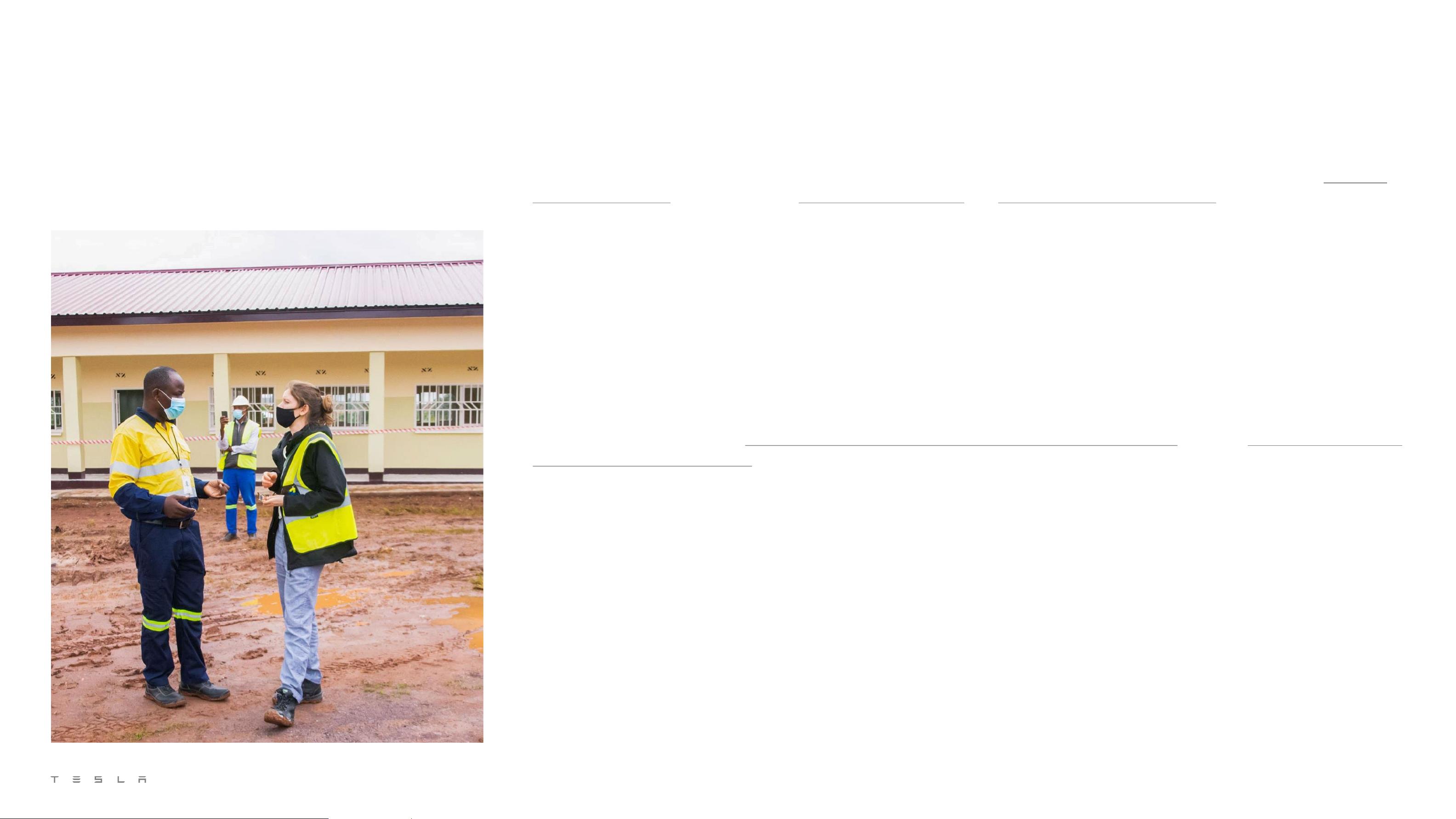

The 2021 Tesla Impact Report highlights the flaws in current ESG evaluation methodologies and emphasizes the need for a shift towards measuring real-world impact. The report emphasizes that current ESG reporting primarily focuses on measuring investment risk in terms of environmental, social, and governance factors, rather than assessing the actual positive impact that companies are making on the world.

The report argues that traditional ESG metrics fail to capture the full scope of a company's impact on society and the environment. Instead of focusing solely on financial returns, ESG evaluations should consider the broader implications of a company's operations on stakeholders and the planet.

Furthermore, the report points out that individual investors who rely on ESG funds managed by large institutions may not be fully aware of the limited scope of current ESG evaluations. This lack of transparency can hinder investors' ability to make informed decisions about which companies align with their values and goals for a sustainable future.

In order to drive meaningful change and address pressing global challenges, the report calls for a more holistic approach to ESG evaluation that measures the actual impact of companies on the world. By shifting the focus from risk assessment to impact assessment, investors can support companies that are making a positive difference and drive positive change in the corporate world.

Overall, the 2021 Tesla Impact Report highlights the need for a paradigm shift in ESG evaluation methodologies to better reflect the true impact of companies on society and the environment. Only by measuring and prioritizing real-world impact can we move towards a more sustainable and equitable future.

2023-08-04 上传

2022-11-04 上传

2021-09-18 上传

2022-03-27 上传

2021-12-15 上传

2021-02-26 上传

2022-01-26 上传

2021-07-26 上传

mugui3

- 粉丝: 0

- 资源: 811

最新资源

- Haskell编写的C-Minus编译器针对TM架构实现

- 水电模拟工具HydroElectric开发使用Matlab

- Vue与antd结合的后台管理系统分模块打包技术解析

- 微信小游戏开发新框架:SFramework_LayaAir

- AFO算法与GA/PSO在多式联运路径优化中的应用研究

- MapleLeaflet:Ruby中构建Leaflet.js地图的简易工具

- FontForge安装包下载指南

- 个人博客系统开发:设计、安全与管理功能解析

- SmartWiki-AmazeUI风格:自定义Markdown Wiki系统

- USB虚拟串口驱动助力刻字机高效运行

- 加拿大早期种子投资通用条款清单详解

- SSM与Layui结合的汽车租赁系统

- 探索混沌与精英引导结合的鲸鱼优化算法

- Scala教程详解:代码实例与实践操作指南

- Rails 4.0+ 资产管道集成 Handlebars.js 实例解析

- Python实现Spark计算矩阵向量的余弦相似度