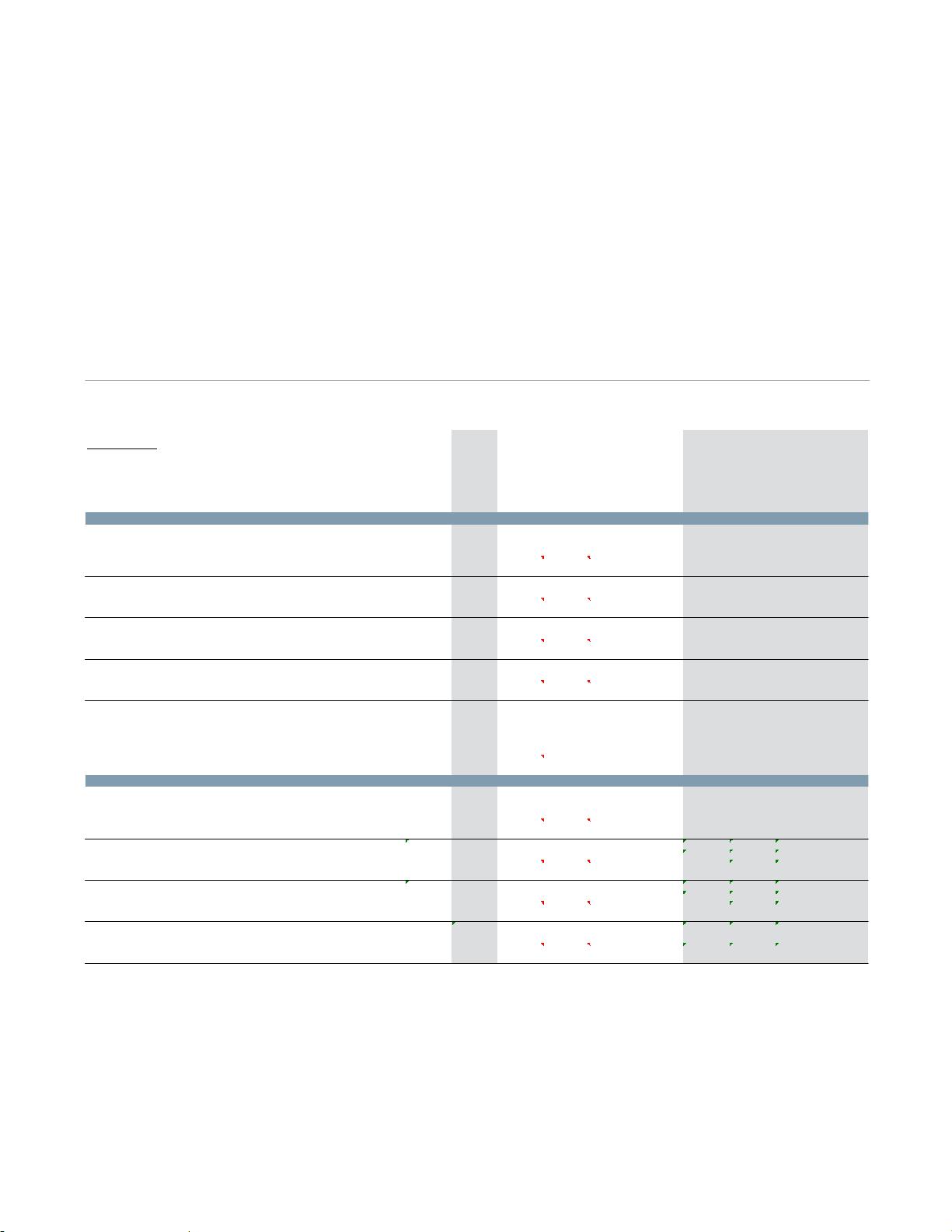

EST EST EST EST EST

Income Statement ($ Millions) 2017 1Q18 2Q18 3Q18 4Q18 2018 1Q19 2Q19 3Q19 4Q19 2019 2020 2021 2022

10/31/2017 1/31/2018 4/30/2018 7/31/2018 10/31/2018 10/31/2018 1/31/2019 4/30/2019 7/31/2019 10/31/2019 10/31/2019 10/31/2020 10/31/2021 10/31/2022

Products 3,410 930 918 907 991 3,746 980 921 949 1,019 3,869 4,160 4,375 4,607

% Growth Y/Y 5.7% 13.7% 9.0% 7.7% 9.1% 9.9% 5.4% 0.3% 4.6% 2.9% 3.3% 7.5% 5.2% 5.3%

% Growth Q/Q -72.7% -1.3% -1.2% 9.3% -73.8% -6.0% 3.0% 7.4%

Services and other 1,062 281 288 296 303 1,168 304 317 325 320 1,266 1,394 1,504 1,624

% Growth Y/Y 8.9% 12.9% 10.8% 8.8% 7.8% 10.0% 8.2% 10.1% 9.8% 5.5% 8.4% 10.2% 7.8% 8.0%

% Growth Q/Q -73.5% 2.5% 2.8% 2.4% -74.0% 4.3% 2.5% -1.7%

Net revenue $4,472 $1,211 $1,206 $1,203 $1,294 $4,914 $1,284 $1,238 $1,274 $1,339 $5,135 $5,555 $5,879 $6,231

% Growth Y/Y 6.4% 13.5% 9.4% 8.0% 8.8% 9.9% 6.0% 2.7% 5.9% 3.5% 4.5% 8.2% 5.8% 6.0%

% Growth Ex-FX 6.9% 10.1% 4.5% 6.4% 10.1% 7.8% 8.3% 5.8% 7.7% 4.8% 6.6% 9.0% 5.8% 6.0%

% Organic Growth 6.6% 9.7% 4.3% 5.9% 8.6% 7.1% 6.1% 3.9% 6.2% 2.3% 4.6% 5.7% 5.8% 6.0%

% Growth Q/Q 1.9% -0.4% -0.2% 7.6% -0.8% -3.6% 2.9% 5.1%

Cost of products ex-Dep./Comp 1,282 334 350 328 356 1,368 359 345 350 365 1,419 1,500 1,561 1,626

% of Product Revenue 37.6% 35.9% 38.1% 36.2% 35.9% 36.5% 36.6% 37.5% 36.9% 35.8% 36.7% 36.1% 35.7% 35.3%

% of Product Revenue inc. Dep./Comp 40.8% 39.5% 41.2% 39.5% 39.0% 39.7% 39.8% 40.8% 40.5% 38.9% 40.0% 39.3% 39.0% 38.6%

Cost of services and other 594 155 160 163 161 639 163 169 171 176 679 767 827 893

% of Service Revenue 55.9% 55.2% 55.6% 55.1% 53.1% 54.7% 53.6% 53.3% 52.6% 55.0% 53.6% 55.0% 55.0% 55.0%

Gross Profit $2,596 $722 $696 $712 $777 $2,907 $762 $724 $753 $799 $3,037 $3,288 $3,491 $3,712

% of Revenue 58.0% 59.6% 57.7% 59.2% 60.0% 59.2% 59.3% 58.5% 59.1% 59.6% 59.1% 59.2% 59.4% 59.6%

% Gross Margin inc. Dep/Comp 55.6% 56.9% 55.4% 56.7% 57.7% 56.7% 56.9% 56.0% 56.4% 57.2% 56.7% 56.7% 56.9% 57.1%

R&D less Stock-Based Comp 333 89 91 96 100 376 100 95 98 105 398 429 450 473

% R&D of Revenue 7.4% 7.3% 7.5% 8.0% 7.7% 7.7% 7.8% 7.7% 7.7% 7.9% 7.8% 7.7% 7.7% 7.6%

% Growth Y/Y 4.7% 11.3% 11.0% 12.9% 16.3% 12.9% 12.4% 4.5% 2.2% 5.2% 6.0% 7.7% 5.0% 5.0%

% Growth Y/Y ex-FX 5.2% 7.9% 6.1% 11.3% 17.5% 10.8% 14.6% 7.6% 4.1% 6.5% 8.1% 8.5% 5.0% 5.0%

SG&A less Stock-Based Comp 1,133 307 307 307 312 1,233 315 315 317 323 1,270 1,352 1,406 1,462

% SG&A ex-comp Revenue 25.3% 25.4% 25.5% 25.5% 24.1% 25.1% 24.5% 25.4% 24.9% 24.2% 24.7% 24.3% 23.9% 23.5%

% Growth Y/Y 4.9% 13.7% 8.9% 8.1% 5.1% 8.8% 2.6% 2.5% 3.3% 3.7% 3.0% 6.4% 4.0% 4.0%

% Growth Y/Y ex-FX 5.4% 10.3% 4.0% 6.5% 6.3% 6.7% 4.8% 5.7% 5.1% 5.0% 5.1% 7.2% 4.0% 4.0%

Total Stock-Based Comp 61 31 12 13 15 71 24 16 18 15 73 80 85 90

% Stock Comp 1.4% 2.6% 1.0% 1.1% 1.2% 1.4% 1.9% 1.3% 1.4% 1.2% 1.4% 1.4% 1.4% 1.4%

Total SG&A 1,194 338 319 320 327 1,304 339 331 335 339 1,343 1,432 1,491 1,552

% SG&A of Revenue 26.7% 27.9% 26.5% 26.6% 25.3% 26.5% 26.4% 26.7% 26.3% 25.3% 26.2% 25.8% 25.4% 24.9%

% Growth Y/Y 4.7% 16.2% 7.4% 8.1% 5.5% 9.2% 0.3% 3.7% 4.5% 3.7% 3.0% 6.6% 4.1% 4.1%

Adj. EBITDA $1,069 $295 $286 $296 $350 $1,227 $323 $298 $320 $354 $1,295 $1,427 $1,550 $1,687

% EBITDA Margin 23.9% 24.4% 23.7% 24.6% 27.0% 25.0% 25.2% 24.1% 25.1% 26.5% 25.2% 25.7% 26.4% 27.1%

% Growth Y/Y 12.2% 19.4% 8.3% 13.8% 17.4% 14.8% 9.5% 4.2% 8.1% 1.3% 5.6% 10.1% 8.6% 8.9%

Depreciation 95 26 25 27 27 105 26 27 30 28 111 117 123 131

% of Net Revenue 2.1% 2.1% 2.1% 2.2% 2.1% 2.1% 2.0% 2.2% 2.4% 2.1% 2.2% 2.1% 2.1% 2.1%

Adj Operating Income (EBIT) $974 $269 $261 $269 $323 $1,122 $297 $271 $290 $326 $1,184 $1,310 $1,426 $1,557

% EBIT Margin 21.8% 22.2% 21.6% 22.4% 25.0% 22.8% 23.1% 21.9% 22.8% 24.4% 23.1% 23.6% 24.3% 25.0%

% Growth Y/Y 13.4% 20.6% 8.3% 14.0% 17.9% 15.2% 10.4% 3.8% 7.8% 1.0% 5.6% 10.6% 8.9% 9.1%

Interest income 22 9 10 9 10 38 10 10 10 6 36 22 24 26

% of Invested Assets 0.84% 1.28% 1.32% 1.14% 1.82% 1.48% 1.73% 1.87% 1.78% 1.25% 1.78% 1.21% 1.27% 1.39%

% Interest Income 0.5% 0.7% 0.8% 0.7% 0.8% 0.8% 0.8% 0.8% 0.8% 0.4% 0.7% 0.4% 0.4% 0.4%

Interest expense (79) (20) (19) (18) (18) (75) (18) (17) (18) (19) (72) (100) (104) (108)

% of Debt Obligations 4.03% 3.98% 3.54% 3.40% 4.00% 3.94% 4.00% 3.78% 4.00% 4.20% 3.32% 3.95% 4.10% 4.25%

% Interest Expense -1.8% -1.7% -1.6% -1.5% -1.4% -1.5% -1.4% -1.4% -1.4% -1.4% -1.4% -1.8% -1.8% -1.7%

Gain on Sale 0 0 0 0 0 0 0

Other income (expense), net 21.0 5.0 6.0 3.0 3.0 17.0 6.0 9.0 6.0 7.5 28.5 30.0 30.0 30.0

Other Income % of Revs 0.5% 0.4% 0.5% 0.2% 0.2% 0.3% 0.5% 0.7% 0.5% 0.6% 0.6% 0.5% 0.5% 0.5%

Pre-Tax Income $938 $263 $258 $263 $318 $1,102 $295 $273 $288 $321 $1,177 $1,262 $1,377 $1,505

% Pre-Tax Margin 21.0% 21.7% 21.4% 21.9% 24.6% 22.4% 23.0% 22.1% 22.6% 24.0% 22.9% 22.7% 23.4% 24.2%

% Growth Y/Y 16.7% 24.1% 11.7% 15.4% 19.1% 17.5% 12.2% 5.8% 9.5% 0.9% 6.8% 7.2% 9.1% 9.3%

Provision for income taxes 169 48 46 47 57 198 50 45 48 54 197 214 234 256

% Tax Rate 18.0% 18.3% 17.8% 17.9% 17.9% 18.0% 16.9% 16.5% 16.7% 16.8% 16.7% 17.0% 17.0% 17.0%

Adj. Net Income $769 $215 $212 $216 $261 $904 $245 $228 $240 $267 $980 $1,047 $1,143 $1,250

% Net Margin 17.2% 17.8% 17.6% 18.0% 20.2% 18.4% 19.1% 18.4% 18.8% 19.9% 19.1% 18.9% 19.4% 20.1%

% Growth Y/Y 18.1% 25.0% 13.4% 13.1% 19.2% 17.6% 14.0% 7.5% 11.1% 2.3% 8.4% 6.9% 9.1% 9.3%

Weighted average shares:

Basic Shares 322 323 322 320 319 321 318 317 312 309 314 304 297 287

Diluted Shares 326 327 326 324 322 325 322 321 316 313 318 308 301 291

Adj. Net income per share:

Adj. Basic EPS $2.39 $0.67 $0.66 $0.68 $0.82 $2.82 $0.77 $0.72 $0.77 $0.86 $3.12 $3.44 $3.85 $4.36

Adj. Diluted EPS $2.36 $0.66 $0.65 $0.67 $0.81 $2.79 $0.76 $0.71 $0.76 $0.85 $3.08 $3.40 $3.80 $4.30

% Growth Y/Y 19.4% 24.6% 13.0% 13.8% 20.7% 17.8% 15.7% 9.2% 13.9% 5.2% 10.7% 10.2% 11.8% 13.2%

Source: Company Documents, Barclays Research