"数据驱动模糊系统设计及金融建模"

需积分: 0 155 浏览量

更新于2023-12-20

收藏 911KB PDF 举报

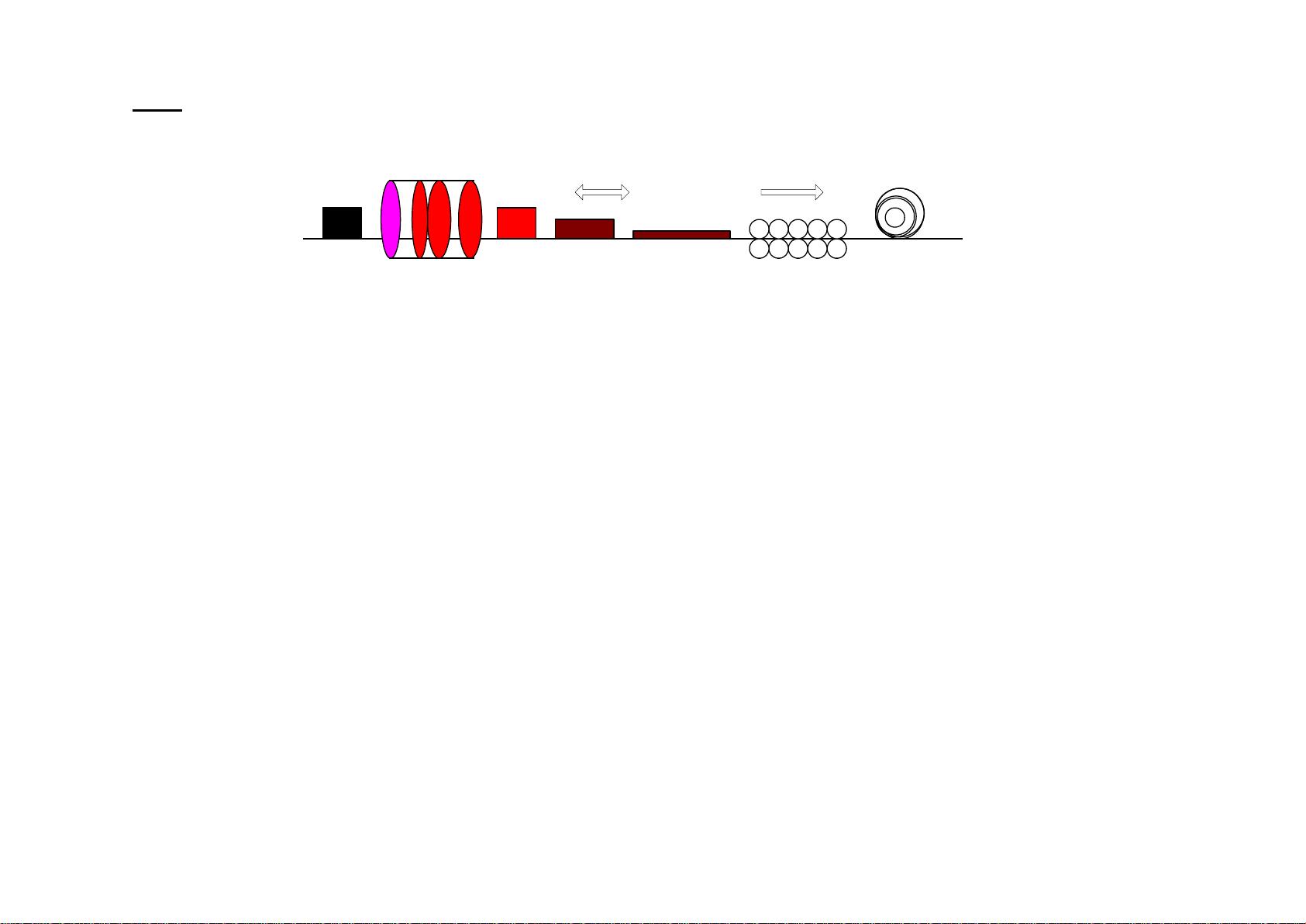

The WM method of designing fuzzy systems based on data is a powerful and versatile approach to creating accurate and effective models. This method involves using human knowledge, conscious knowledge, and subconscious knowledge to view the expert as a black box and measure its inputs.

Fuzzy neural networks are another important tool for designing fuzzy systems based on data. These networks combine the principles of fuzzy logic and neural networks to create models that can effectively process and interpret complex data sets.

The recursive least squares and clustering methods are also valuable techniques for designing data-driven fuzzy systems. These methods allow for the refinement and optimization of fuzzy models based on continuous data input.

One particularly compelling application of fuzzy systems in finance modeling. By leveraging the power of fuzzy logic and data-driven design, these systems can effectively model and predict market behaviors, make accurate investment decisions, and manage risk in the complex and dynamic world of finance.

In conclusion, the WM method, fuzzy neural networks, recursive least squares, and clustering methods are all powerful tools for designing data-driven fuzzy systems. When applied to finance modeling, these systems can provide valuable insights and predictions that can inform investment decisions and risk management strategies. With their ability to process and interpret complex data, these systems have the potential to revolutionize the way we approach finance and other fields that rely on accurate modeling and prediction.

2022-08-03 上传

2021-08-22 上传

2021-05-11 上传

2022-06-24 上传

2021-02-13 上传

2021-07-13 上传

2021-07-13 上传

101 浏览量

乔木Leo

- 粉丝: 32

- 资源: 301

最新资源

- SMS_Flatrate

- tugas_pemweb_1

- BrowTricks:美发沙龙预订应用

- PFMeetingAPI:计划和反馈会议工具的 Api REST

- 碳管理

- 房地产培训资料

- 内部定时器原理图及程序

- 井字游戏:游戏

- elixir-libvips:libvips的实验绑定

- VC6.0实现POST和Get,调用后端WEBAPI接口_MFC版.rar

- XX项目全程企划及销售执行报告

- app-store-parser-frontend

- bigdata-finance

- dtFFT:dtFFT-数据类型的快速傅立叶变换

- unity 绿幕抠像插件

- WorldFixer:@ Creeperface01PHP版本的WorldFixer