"高盛:墨西哥股票与债券错位投资策略的新兴市场趋势"

需积分: 0 106 浏览量

更新于2024-03-12

收藏 1.15MB PDF 举报

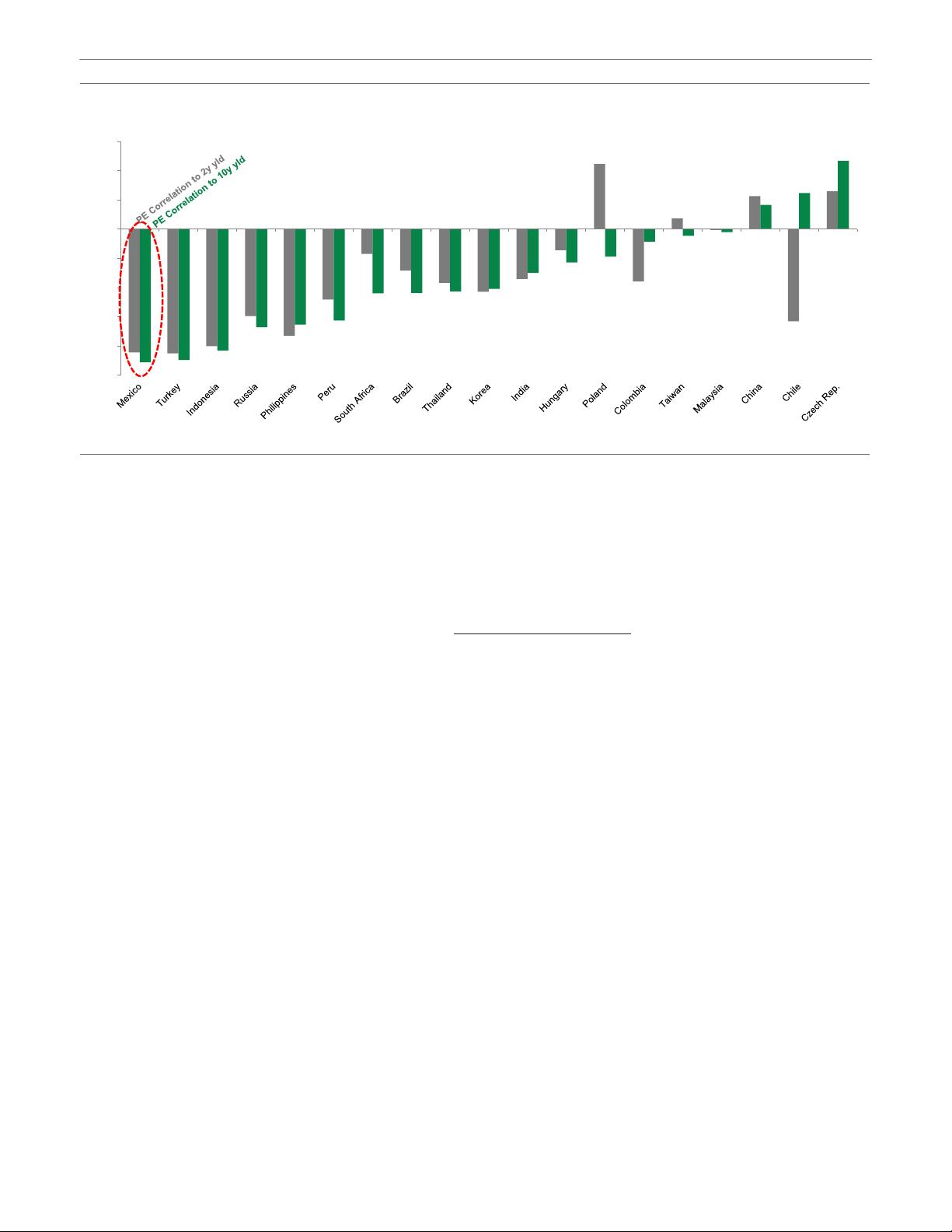

The document "High Yield- Emerging Markets- Investment Strategy- The Misalignment of Mexican Stocks and Bonds, an Unusual Emerging Market Trend-0315-26 pages.pdf" discusses the unique trend in the emerging market of Mexico where there is a misalignment between stock and bond investments. Despite the differences in investor base and index composition, there is a high correlation between EM equities and local bonds, especially for high-yielders in EM. The document highlights consistent delayed spillover effects into EM equity markets when EM rates decline, indicating a strong relationship between the two asset classes.

In particular, Mexico stands out among emerging markets as having the most inversely correlated equity multiples with local rates, both at the front-end and long-end. This means that changes in local rates have a significant impact on the valuation of Mexican stocks, leading to a unique investment opportunity for investors looking to diversify their portfolios in the emerging market space.

The document emphasizes the importance of understanding the dynamics of the Mexican market and the relationship between stocks and bonds in order to capitalize on this trend. By recognizing the correlation between local rates and equity multiples, investors can make informed decisions about their investments in Mexico and potentially achieve higher returns.

Overall, the misalignment of Mexican stocks and bonds presents an interesting opportunity for investors to take advantage of the unique trend in the emerging market. By leveraging the correlation between EM equities and local bonds, investors can optimize their portfolios and potentially generate substantial returns in Mexico. The document sheds light on this unconventional investment strategy and provides valuable insights for investors seeking to navigate the complexities of the emerging market landscape.

2023-07-24 上传

2023-07-26 上传

2023-07-25 上传

153 浏览量

114 浏览量

2024-10-28 上传

151 浏览量

2024-10-28 上传

2024-11-01 上传

wsnbb_2023

- 粉丝: 17

- 资源: 6001

最新资源

- 华为内部linux教程

- 微软ASP.NET AJAX框架剖析

- MPEG-4 ISO 标准 ISO/IEC14496-5

- 转贴:随心所欲的Web页面打印技术

- c语言100例.doc

- JSP数据库编程指南.pdf

- 完全精通局域网-局域网速查手册

- ENVI遥感影像处理专题与实践\用户指南与实习指南.pdf

- 软考试卷06下cxys.pdf

- usb设备驱动开发详解-讲座

- 深入浅出Win32多线程程序设计

- 水文控制系统子程序详细的mp430程序

- John.Lions-Lions'.Commentary.on.UNIX.6th.Edition.with.Source.Code.pdf

- PHP和MySQL Web开发 第四版

- ArcGIS Server 9.2 javascript ADF核心 帮助文档

- java 基础及入门