"2023年第一季度美元牛市暂停:硅谷银行经济报告"

需积分: 0 38 浏览量

更新于2023-12-28

收藏 2.47MB PDF 举报

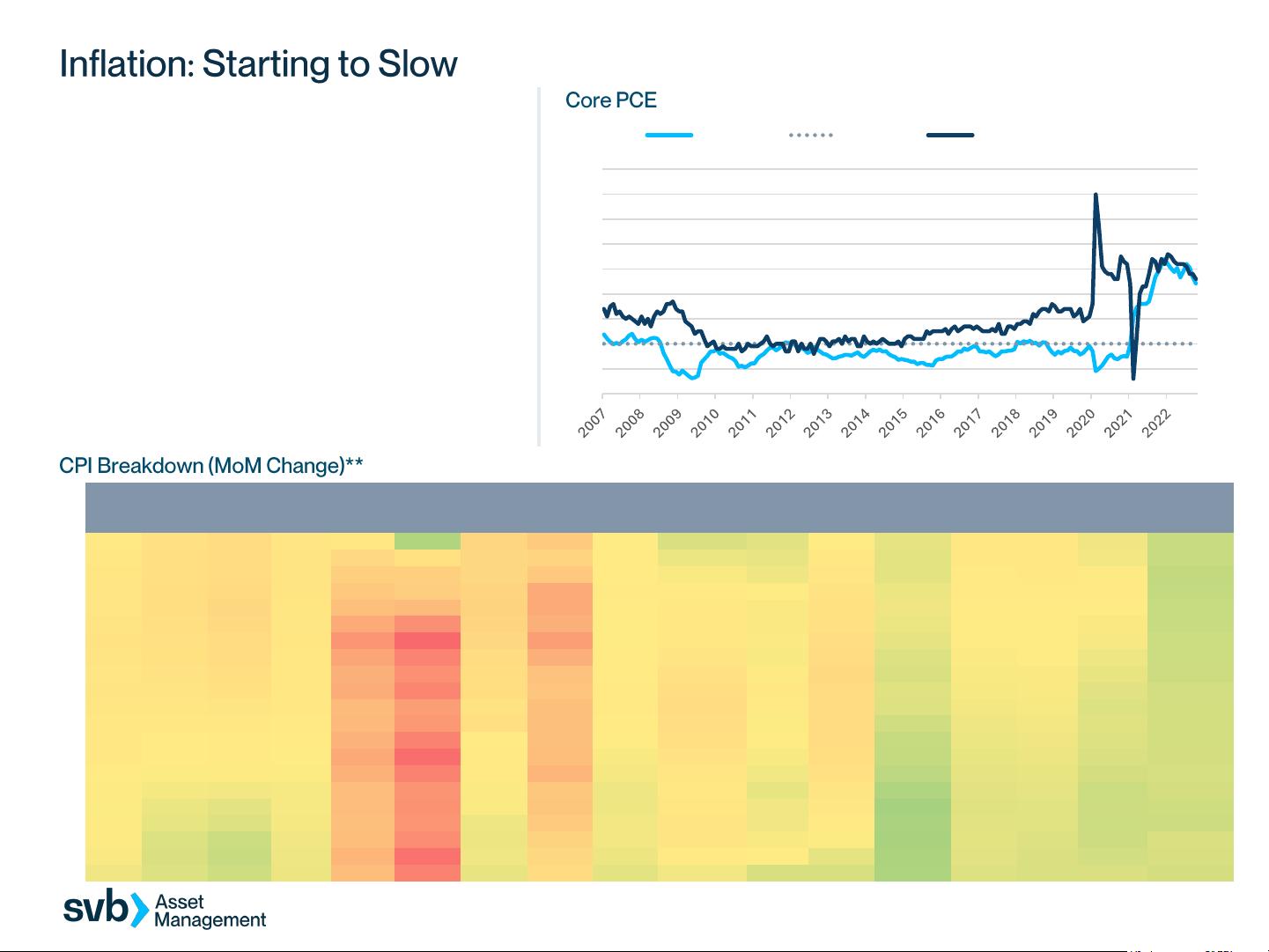

The first quarter of 2023 saw a temporary pause in the bull run of the US dollar (USD), as the currency reversed sharply in Q4 of the previous year. This reversal was driven by the pricing in of Federal Reserve rate hikes and improved global economic conditions. Looking ahead, it is likely that the Fed will continue to tighten monetary policy, albeit at a slower pace than in previous quarters.

The Federal Reserve's focus on lowering inflation to its target 2% rate has been a key driver of its decision-making, and ongoing increases to the fed funds rate are anticipated in the near term. Despite this, the Fed's approach is expected to be less aggressive than in the past, reflecting a more cautious and deliberate strategy.

In the corporate credit market, spreads tightened in Q4 2022, indicating a reduced risk perception among investors. This was accompanied by indications that the pace of Fed policy tightening would slow, along with signs of improving economic conditions globally.

Looking ahead, it is important for investors to monitor the Federal Reserve's actions and communications closely, as they will continue to be a key driver of market sentiment and volatility. Additionally, ongoing developments in the global economy, particularly in relation to inflation and monetary policy, will likely have significant implications for asset prices and investment strategies.

In summary, the first quarter of 2023 saw a temporary pause in the USD bull run, driven by a reversal in Fed policy and improved global economic conditions. While the Fed remains committed to lowering inflation and tightening monetary policy, the pace of these actions is expected to be less aggressive in the near term. These developments have had significant implications for corporate credit markets and investor risk perception, and will continue to be important factors to monitor in the coming months.

2023-06-12 上传

2023-06-08 上传

2023-12-16 上传

2023-04-01 上传

2024-02-22 上传

2024-07-17 上传

2023-08-26 上传

2023-08-29 上传

2023-07-28 上传

车东-csdn

- 粉丝: 1025

- 资源: 139

最新资源

- Postman安装与功能详解:适用于API测试与HTTP请求

- Dart打造简易Web服务器教程:simple-server-dart

- FFmpeg 4.4 快速搭建与环境变量配置教程

- 牛顿井在围棋中的应用:利用牛顿多项式求根技术

- SpringBoot结合MySQL实现MQTT消息持久化教程

- C语言实现水仙花数输出方法详解

- Avatar_Utils库1.0.10版本发布,Python开发者必备工具

- Python爬虫实现漫画榜单数据处理与可视化分析

- 解压缩教材程序文件的正确方法

- 快速搭建Spring Boot Web项目实战指南

- Avatar Utils 1.8.1 工具包的安装与使用指南

- GatewayWorker扩展包压缩文件的下载与使用指南

- 实现饮食目标的开源Visual Basic编码程序

- 打造个性化O'RLY动物封面生成器

- Avatar_Utils库打包文件安装与使用指南

- Python端口扫描工具的设计与实现要点解析