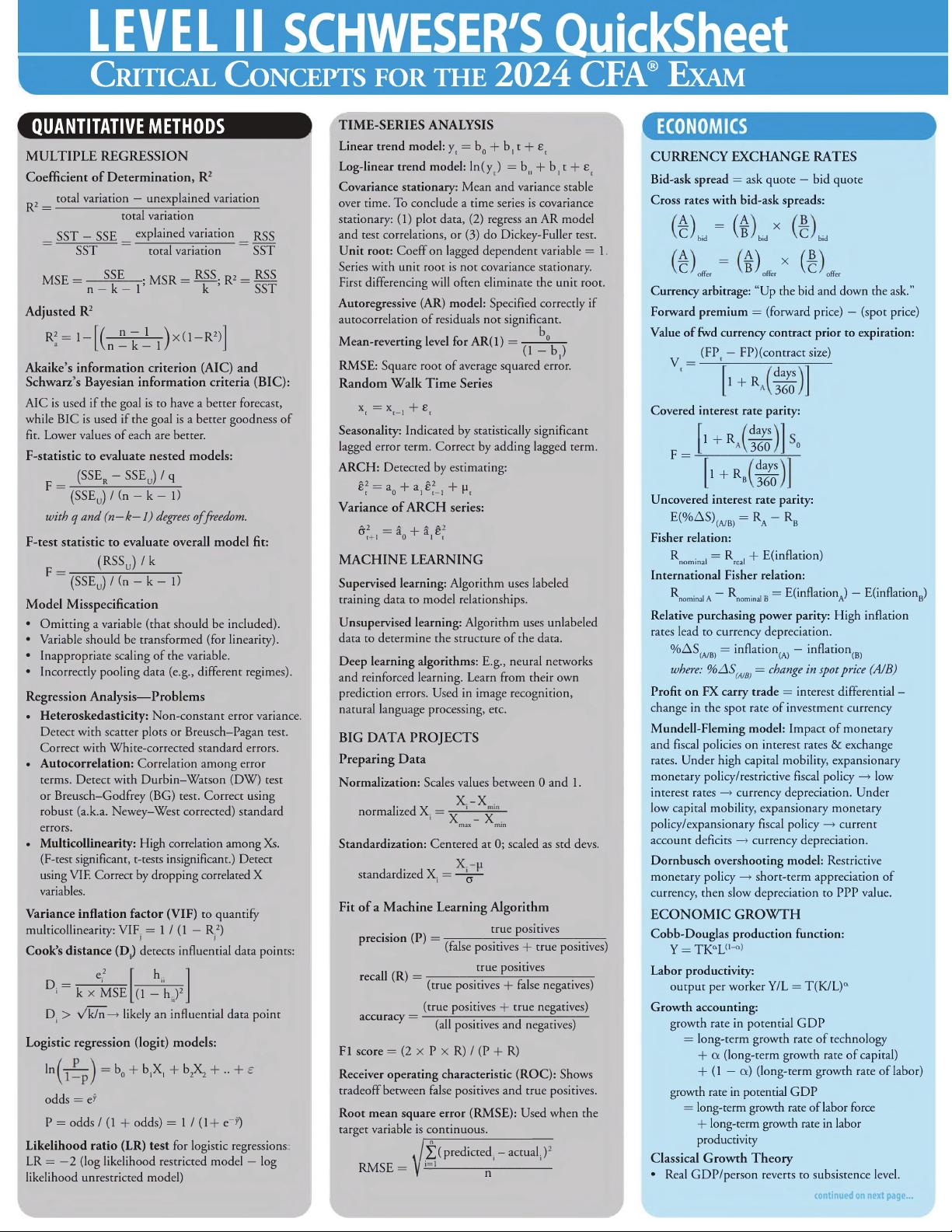

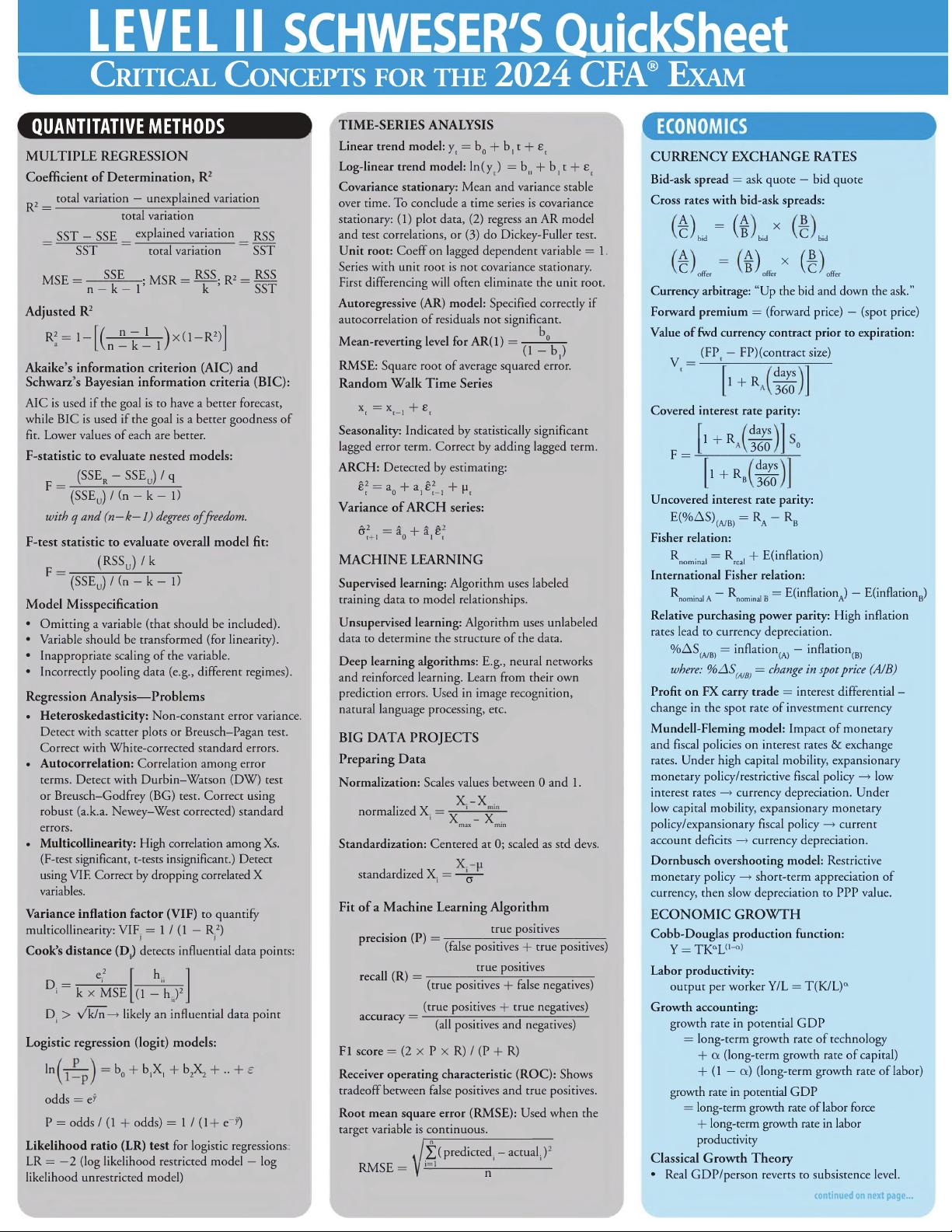

l Critical C oncepts for the 2024 CFA® Exam

QUANTITATIVE METHODS

MULTIPLE REGRESSION

Coefficient of Determination, R2

total variation — unexplained variation

R2 =

total variation

SST — SSE explained variation

SST total variation

RSS

SST

MSE =

SSE

-------------

• MSR = RSS- R2 = RSS

n-k-1’ k ’ SST

Adjusted R2

R2= 1 -

te^r)x(]-R2)

Akaikes information criterion (AIC) and

Schwarz s Bayesian information criteria (BIC):

AIC is used if the goal is to have a better forecast,

while BIC is used if the goal is a better goodness of

fit. Lower values of each are better.

F-statistic to evaluate nested models:

F =

(SSE

r - SSE„) / q

(SSEJ/fn-k- 1)

with q and (n—k—1) degrees o f freedom.

F-test statistic to evaluate overall model fit:

r (RSSu)/k

(SSEa) / (n — k — 1)

Model Misspecification

• Omitting a variable (that should be included).

• Variable should be transformed (for linearity).

• Inappropriate scaling of the variable.

• Incorrectly pooling data (e.g., different regimes).

Regression Analysis—Problems

• Heteroskedasticity: Non-constant error variance.

Detect with scatter plots or Breusch-Pagan test.

Correct with White-corrected standard errors.

• Autocorrelation: Correlation among error

terms. Detect with Durbin-Watson (DW) test

or Breusch-Godfrey (BG) test. Correct using

robust (a.k.a. Newey—West corrected) standard

errors.

• Multicollinearity: High correlation among Xs.

(F-test significant, t-tests insignificant.) Detect

using VIF. Correct by dropping correlated X

variables.

Variance inflation factor (VIF) to quantify

multicollinearity: VIF. = 1/(1 — R.2)

Cook’s distance (D.) detects influential data points:

D =

e2

i

r h..

11

k

x MSE

(i - h..)2

L ir

D. > v k / n —> likely an influential data point

Logistic regression (logit) models:

In

- b0 + blXl + b2X2 + " +

odds = e^

P = odds / (1 + odds) = 1 / ( 1 + e- y)

Likelihood ratio (LR) test for logistic regressions:

LR = — 2 (log likelihood restricted model — log

likelihood unrestricted model)

TIME-SERIES ANALYSIS

Linear trend model: y = b„ + b, t + e

J t 0 I t

Log-linear trend model: ln(y ) = b(i + b t t + £

Covariance stationary: Mean and variance stable

over time. To conclude a time series is covariance

stationary: (1) plot data, (2) regress an AR model

and test correlations, or (3) do Dickey-Fuller test.

Unit root: Coeff on lagged dependent variable = 1,

Series with unit root is not covariance stationary.

First differencing will often eliminate the unit root.

Autoregressive (AR) model: Specified correctly if

autocorrelation of residuals not significant.

Mean-reverting level for AR( 1) =

o

(1 - b , )

RMSE: Square root of average squared error.

Random Walk Time Series

xt = Xt-1 + c

Seasonality: Indicated by statistically significant

lagged error term. Correct by adding lagged term.

ARCH: Detected by estimating:

g? = ao + ai g?-i + H

Variance of ARCH series:

+i=ao + a,e.

MACHINE LEARNING

Supervised learning: Algorithm uses labeled

training data to model relationships.

Unsupervised learning: Algorithm uses unlabeled

data to determine the structure of the data.

Deep learning algorithms: E.g., neural networks

and reinforced learning. Learn from their own

prediction errors. Used in image recognition,

natural language processing, etc.

BIG DATA PROJECTS

Preparing Data

Normalization: Scales values between 0 and 1.

X -X .

normalized X. =

X - X

max min

Standardization: Centered at 0; scaled as std devs.

standardized X. =

a

Fit of a Machine Learning Algorithm

precision (P) =

recall (R) =

true positives

(false positives + true positives)

true positives

accuracy =

(true positives + false negatives)

(true positives + true negatives)

(all positives and negatives)

Fl score = (2

x P x R) / (P + R)

Receiver operating characteristic (ROC): Shows

tradeoff between false positives and true positives.

Root mean square error (RMSE): Used when the

target variable is continuous.

n

2 ( predicted. - actual.)

RMSE = " i=1

n

CURRENCY EXCHANGE RATES

Bid-ask spread = ask quote — bid quote

Cross rates with bid-ask spreads:

$L - (*

bid

x

bid x ^ ' bid

A

C

offer

4) X ( B

D 7 offer V ^ ' offer

Currency arbitrage: “Up the bid and down the ask.”

Forward premium = (forward price) — (spot price)

Value of fwd currency contract prior to expiration:

(FP — FP)(contract size)

V =

1 + R

days

360

Covered interest rate parity:

days

F =

1 + R

360

o

1 + R

B

days

360

Uncovered interest rate parity:

E(% A SW , = Ra - Rb

Fisher relation:

R . = R . + E(inflation)

nominal real

International Fisher relation:

R . .. — R . | = E(inflation,) — E(inflation„)

nominal A nominal d x A' v d '

Relative purchasing power parity: High inflation

rates lead to currency depreciation.

%AS,.m, = inflatio n .. . — inflation,-,

(A/B) (A) (B)

where: %AS(a/B) = change in spot price (A/B)

Profit on FX carry trade = interest differential -

change in the spot rate of investment currency

Mundell-Fleming model: Impact of monetary

and fiscal policies on interest rates & exchange

rates. Under high capital mobility, expansionary

monetary policy/restrictive fiscal policy —> low

interest rates —» currency depreciation. Under

low capital mobility, expansionary monetary

policy/expansionary fiscal policy —> current

account deficits —*• currency depreciation.

Dornbusch overshooting model: Restrictive

monetary policy —» short-term appreciation of

currency, then slow depreciation to PPP value.

ECONOMIC GROWTH

Cobb-Douglas production function:

Y = TKaL(1_ot)

Labor productivity:

output per worker Y/L = T(K/L)a

Growth accounting:

growth rate in potential GDP

= long-term growth rate of technology

+ ot (long-term growth rate of capital)

+ (1 — a) (long-term growth rate of labor)

growth rate in potential GDP

= long-term growth rate of labor force

+ long-term growth rate in labor

productivity

Classical Growth Theory

• Real GDP/person reverts to subsistence level.

continued on next page...