9

Daniel P Hui

(1-212) 834-5997

daniel.hui@jpmorgan.com

Patrick R Locke

(1-212) 834-4254

patrick.r.locke@jpmchase.com

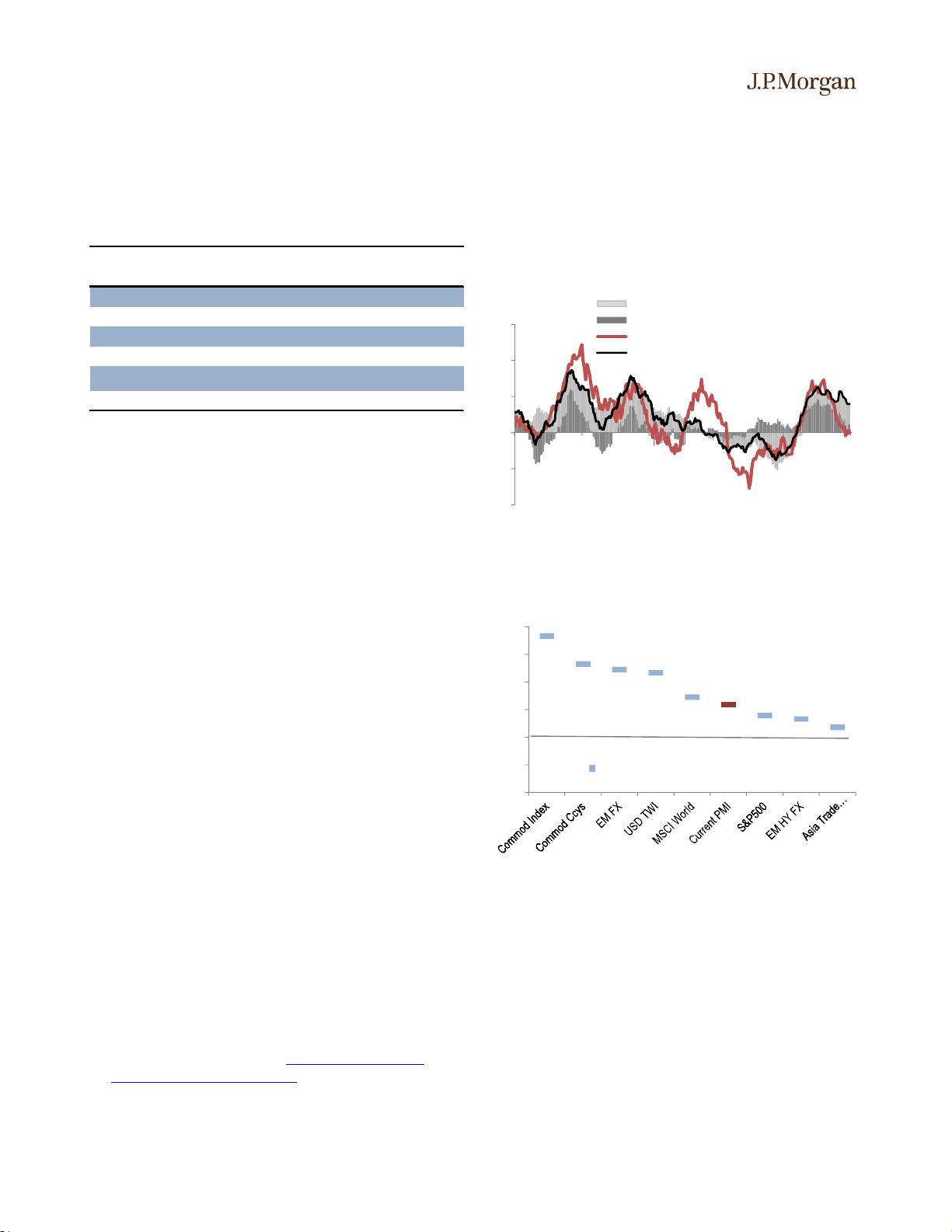

policy expectations, we have recently flagged that many

global risky assets, including high-yielding and growth

sensitive currencies, have already priced in a material

rebound in the global manufacturing cycle (Exhibit 2;

FXMW: The pricing of great expectations when reality

bites, 1 March). This adds to our assessment that a

material and sustained upgrade to the broad global

growth outlook is necessary for the US’s growth

deceleration and Fed's new dovish stance to translate

into a sustained broad-based dollar downtrend (Exh. 3).

The dollar’s vulnerabilities are mounting, but

remain chronic or contingent for now, rather than

acute. While above we have argued that the dollar has

remained strong and resilient for very good reasons of

near-term cyclical outcomes, this does not discount a

recognition that there are a number of mounting

vulnerabilities for the dollar which have been less

expressed to-date, either because they are chronic and

structural in nature rather than acute, or are

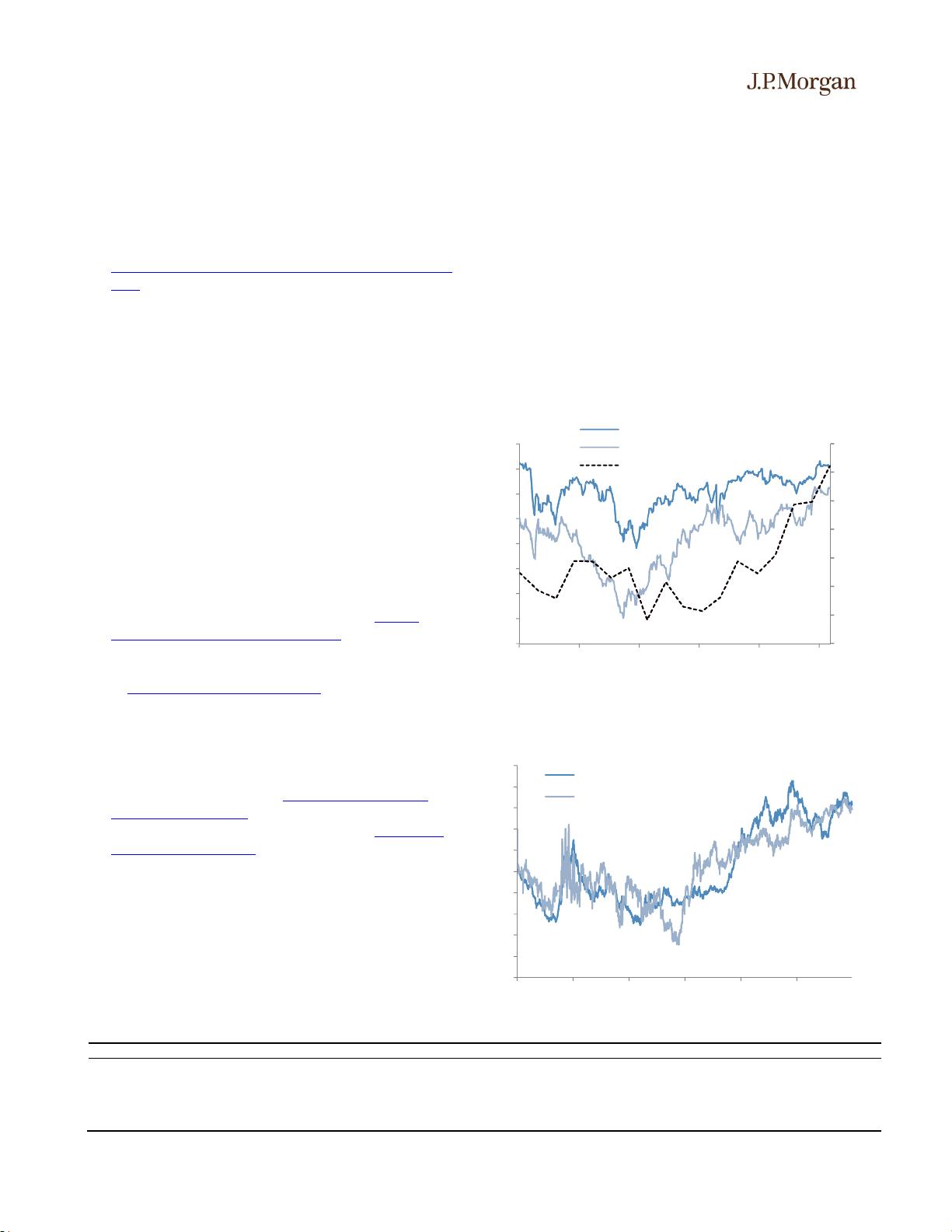

contingent. One contingent vulnerability is the

forthcoming review of the Fed framework; although we

believe preliminary discussions around the desire to

raise medium-term inflation expectations is already

resulting in more dovish Fed rhetoric (see FOMC

preview, and change in our Fed view, 14 March), the

bigger impact on the dollar may come only if and when

inflation expectations actually materially shift (Exhibit

4; FXMW Who let the doves out?, 22 Feb). And this is

something that may only come later in the process when

the conclusions of the Fed framework rethink are more

formally articulated. These layer on top of the more

perennial chronic structural drags on the dollar which

have long been identified, including the notably

widening twin deficits (see The messy story of twin

deficits and the dollar, Feb 2018) and the potential loss

of hegemonic reserve currency status (see The USD’s

reserve currency status, Oct 2018).

Washington policies and politics remain another

contingent vulnerability. For now, a US-China trade

deal is not likely to be finalized until at least April, auto

tariffs remain a wildcard in trade negotiations with

Europe and Japan, USMCA ratification faces a

distinctly steep uphill battle in Congress, and Democrats

continue to offer little in the way of legislative

cooperation with the Trump administration. A

potentially imminent event in Washington’s near future,

however, is the release of the highly anticipated Mueller

report, said to be nearing completion. We believe that

USD will see through much of the noise surrounding the

initial release, unless the Mueller findings allow for a

direct line towards impeachment, in which case the 1998

Clinton impeachment playbook for the dollar would

provide the closest approximate template, which would

point to dollar downside.

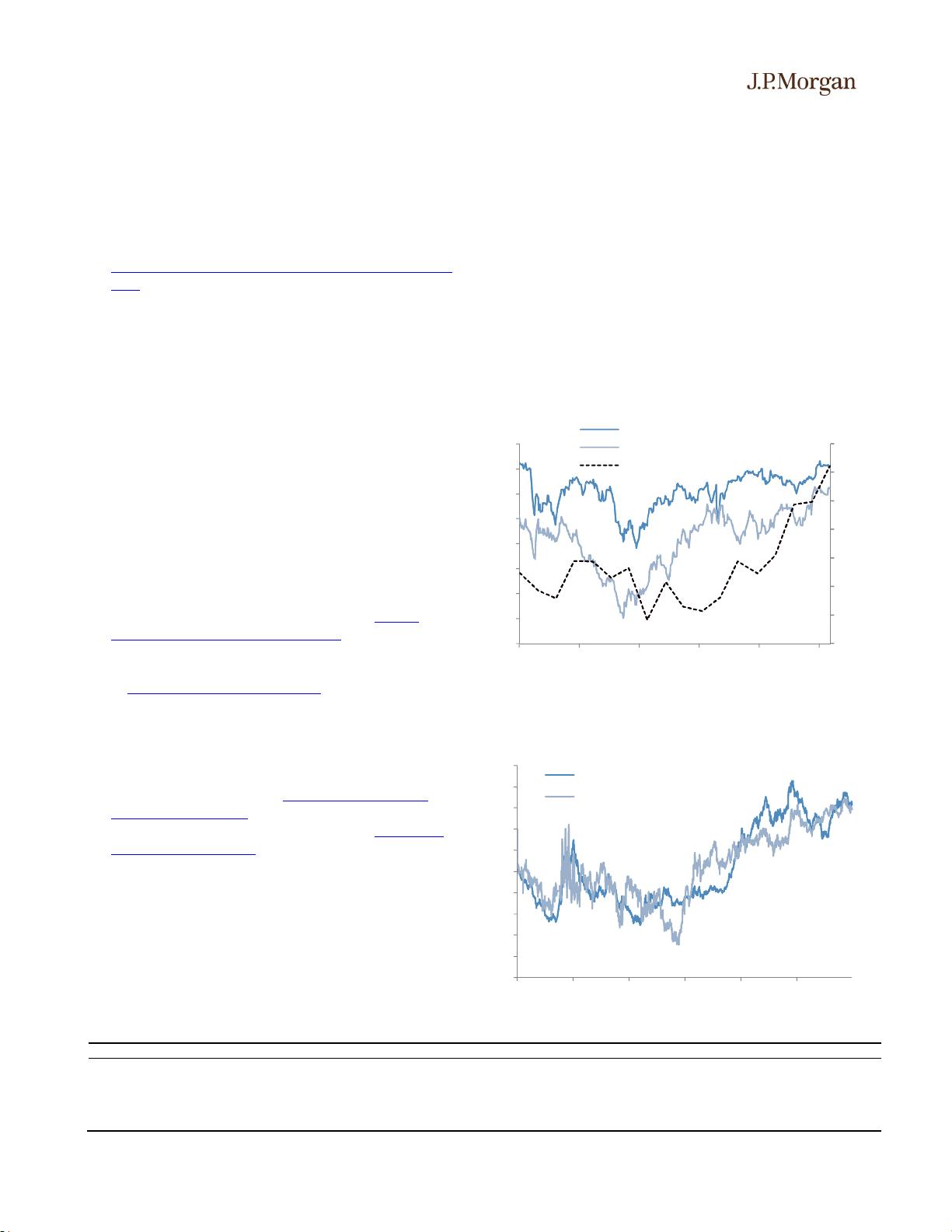

Exhibit 3: In 2016, markets waited patiently after the January risky

market trough for 4-5 months before the global PMI started picking

up and delivering on earlier expectations

LHS: MSCI World & JPM Commodity index, 1-Mar-18=100; RHS: Global Mfg PMI

Source: JPMorgan

Exhibit 4: A simple real-rate spread model suggests a 50bp rise in

inflation expectations could weaken the dollar by 6%

USD Index = 97.03 + 11.46 * (Real yield spread between US and equally

weighted basket of EU, UK, JP), RSQ = 75%

Source: JPMorgan; Note: Real Yield of 10y government bond yields less 5y5y inflation breakevens

Table 2: Alternative scenarios to base-case view

Bearish: (1) Global growth rebounds vigorously (2) Trade conflict is eliminated (3) Washington

issues worsen including disruption from the Mueller investigation or Debt Ceiling

Bullish: (1) US cyclical exceptionalism extends; (2) Global growth rebound fails to materialize;

(3) Trade tensions worsen (4) Fed communication turns more hawkish

FOCM Mar 20; NFP Apr 5; Flash PMIs Mar

22, Core PCE Apr 1, CPI Apr 10

Fed speak, news on trade war, USMCA,

Mueller Investigation, debt ceiling

49.5

50

50.5

51

51.5

52

52.5

53

65

70

75

80

85

90

95

100

105

JPMCCI Aggregate Price Index

Global Manuf PMI

80

85

90

95

100

105

110

115

120

125

130

Mar-07 Mar-09 Mar-11 Mar-13 Mar-15 Mar-17

USD Index

Real Yield Spd Model