电子音乐原理和技术电子书

需积分: 9 61 浏览量

更新于2024-07-17

收藏 2.01MB PDF 举报

"电子音乐理论和技术"

本电子书《The Theory and Technique of Electronic Music》由 Miller Puckette 撰写,是一本全面介绍电子音乐原理的电子书。下面是根据书中的内容生成的相关知识点:

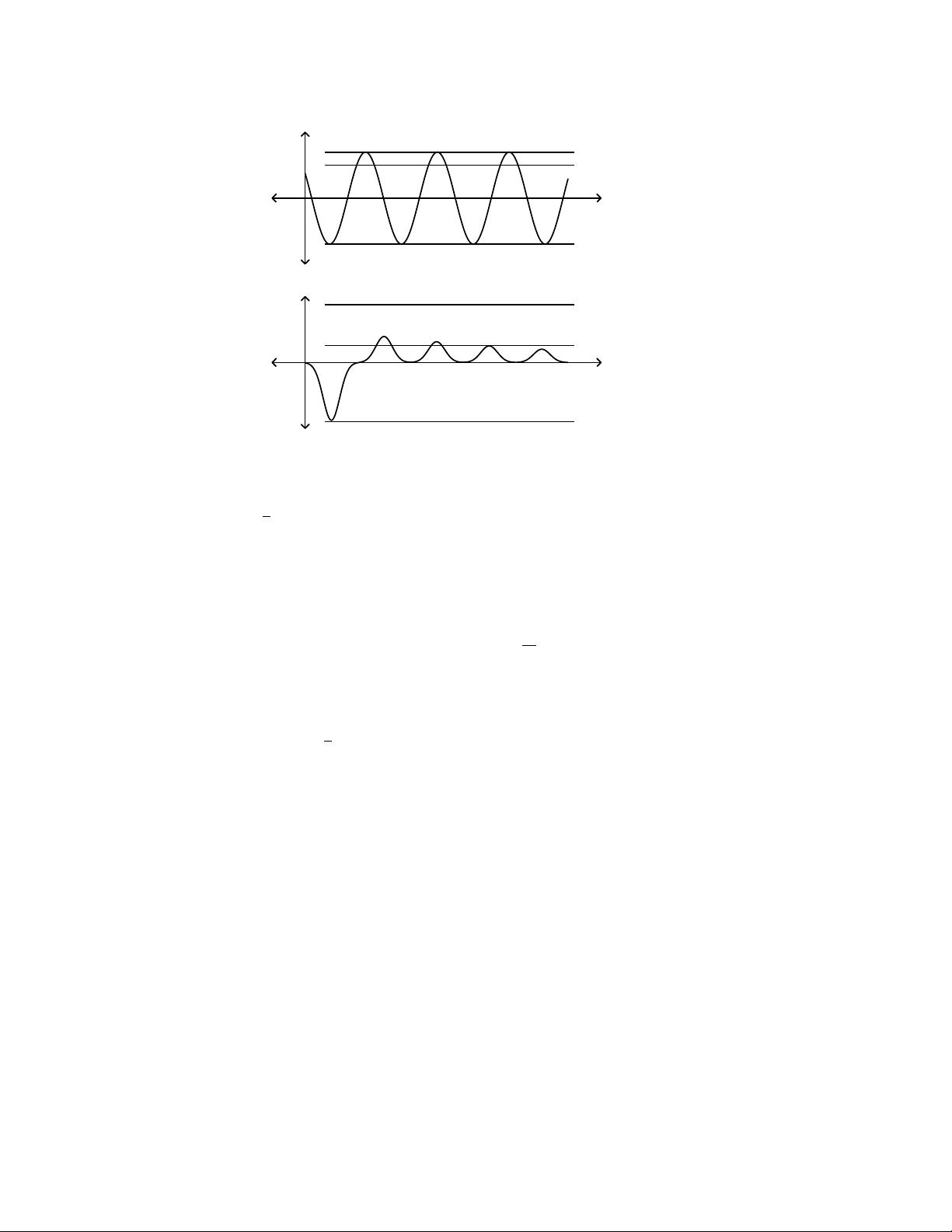

一、正弦波、幅值和频率

* Measures of Amplitude:幅值的度量单位有 dB、Watt、 Volt 等。

* Units of Amplitude:幅值的单位有 dB、Watt、 Volt 等。

* Controlling Amplitude:可以通过调整音量、增益等方式来控制幅值。

* Frequency:频率是指每秒钟内振荡的次数,单位是 Hz。

* Synthesizing a Sinusoid:可以通过加法合成或频率变换来合成正弦波。

* Superposing Signals:可以将多个信号叠加以生成新的信号。

* Periodic Signals:周期信号是一种重复出现的信号,例如正弦波。

二、波表和采样器

* Wavetable Oscillator:波表振荡器是一种使用波表来生成音频信号的方法。

* Sampling:采样是指将连续信号转换为离散信号的过程。

* Enveloping Samplers:包络采样是指对采样信号进行包络处理以生成新的音频信号。

* Timbre Stretching:音色拉伸是一种将音色变化的技术。

* Interpolation:插值是一种用于生成新的音频信号的技术。

三、Pd 软件介绍

* Quick Introduction to Pd:Pd 是一种基于图形化编程的音频处理软件。

* How to find and run the examples:如何在 Pd 中找到和运行示例程序。

四、练习和更多内容

* Exercises:本书提供了一些练习题,以帮助读者更好地理解电子音乐理论和技术。

* More Additive Synthesis:加性合成是一种生成音频信号的技术。

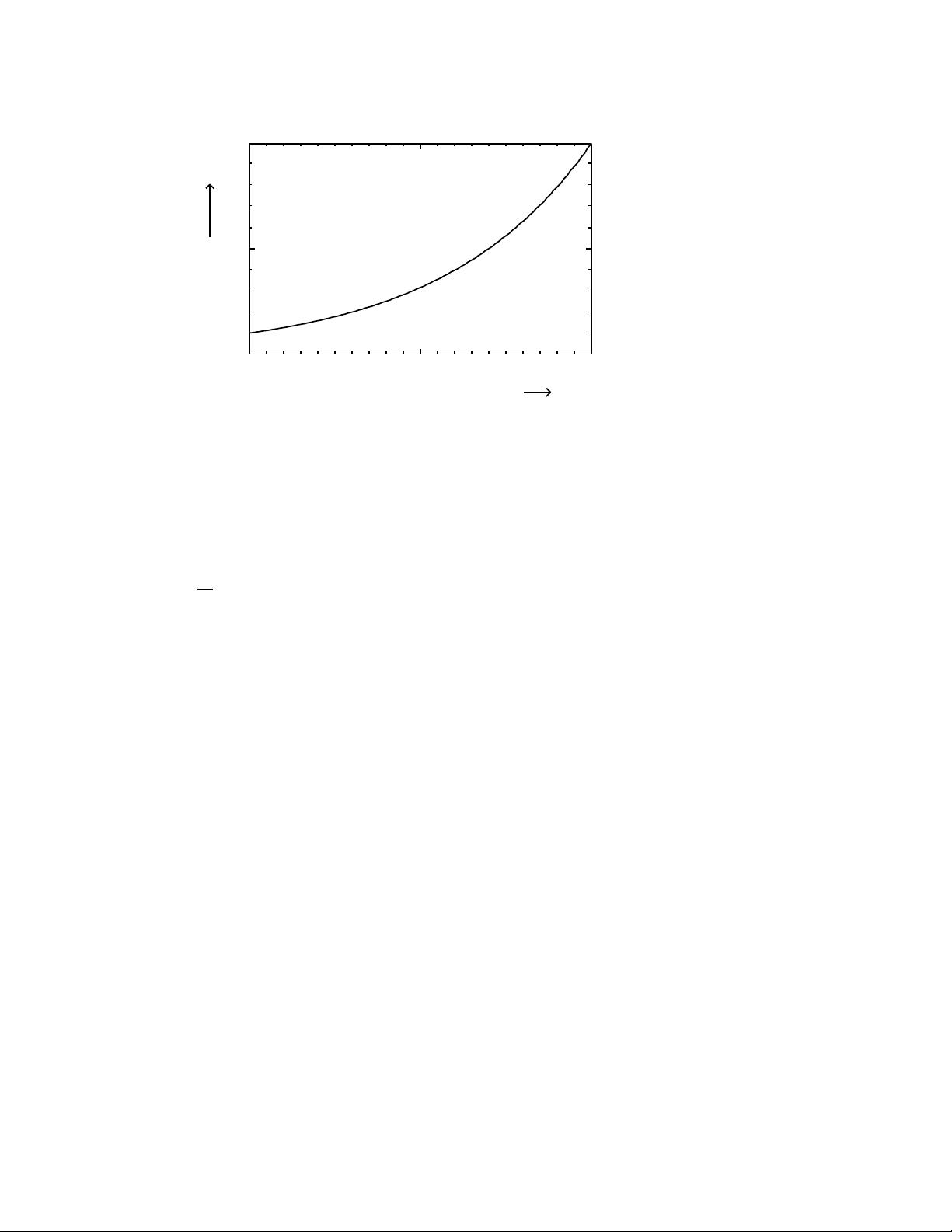

* Conversion between Frequency and Pitch:频率和音高之间的转换。

本电子书《The Theory and Technique of Electronic Music》为读者提供了电子音乐理论和技术的系统介绍,涵盖了正弦波、幅值和频率、波表和采样器、Pd 软件等多方面的知识点,是电子音乐爱好者和专业人士不可错过的良好资源。

2019-11-15 上传

2014-09-26 上传

2023-05-17 上传

2023-06-11 上传

2023-09-19 上传

2023-05-04 上传

2023-03-29 上传

2023-09-09 上传

2023-05-20 上传

imliyucai

- 粉丝: 0

- 资源: 1

最新资源

- Hadoop生态系统与MapReduce详解

- MDS系列三相整流桥模块技术规格与特性

- MFC编程:指针与句柄获取全面解析

- LM06:多模4G高速数据模块,支持GSM至TD-LTE

- 使用Gradle与Nexus构建私有仓库

- JAVA编程规范指南:命名规则与文件样式

- EMC VNX5500 存储系统日常维护指南

- 大数据驱动的互联网用户体验深度管理策略

- 改进型Booth算法:32位浮点阵列乘法器的高速设计与算法比较

- H3CNE网络认证重点知识整理

- Linux环境下MongoDB的详细安装教程

- 压缩文法的等价变换与多余规则删除

- BRMS入门指南:JBOSS安装与基础操作详解

- Win7环境下Android开发环境配置全攻略

- SHT10 C语言程序与LCD1602显示实例及精度校准

- 反垃圾邮件技术:现状与前景