© VisionMobile 2014 | www.DeveloperEconomics.com/go

10

VisionMobile over a period of five weeks between October and late

November 2013. One to one interviews were conducted in November and

December 2013.

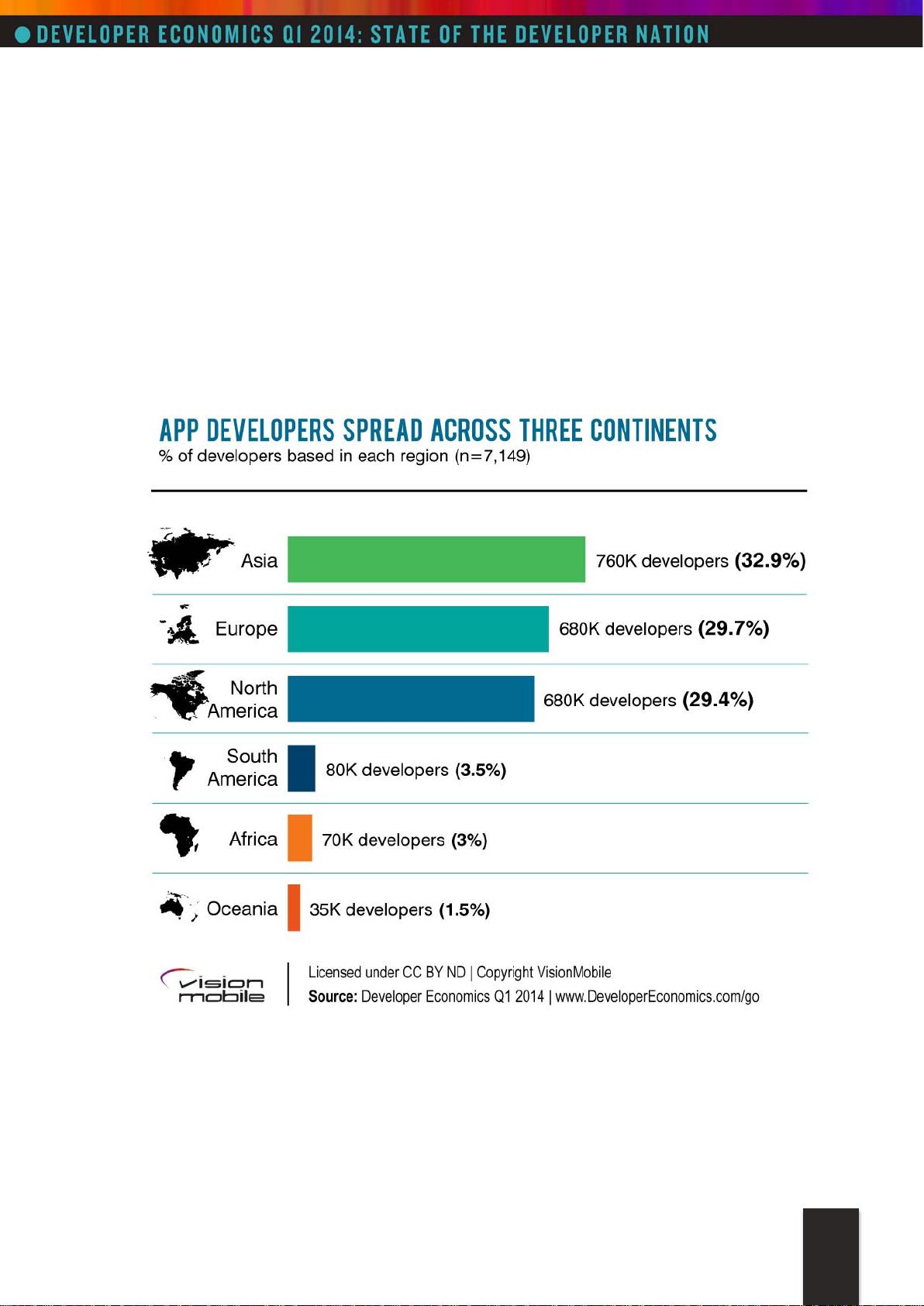

The online survey received over 7,000 responses, making this the largest

mobile developer survey to date. Respondents to the online survey came

from over 127 countries, including major app development hotspots such as

the US, China, India, Israel, UK and Russia and stretching all the way to

Kenya, Brasil and Jordan. The geographic reach of this survey is truly

reflective of the global scale of the mobile app economy.

The online survey was translated in 6 languages (Chinese, German, Japanese,

Korean, Russian, Spanish) and promoted by 60 regional and media partners

within the app development industry. As a result, the survey reached an

unprecedented number of respondents, globally balanced across Europe

(36.5%), Asia (32.1%) and North America (19.7%). The online survey also

attracted a significant developer sample from Africa (6.6%) and South

America (3.4%).

To eliminate the effect of regional sampling biases, we weighted the regional

distribution by a factor that was determined by the regional distribution

identified in our App Economy Forecasts (2013 - 2016) report published in

July 2013, as shown in the graph above.

The survey gathered responses from developers across 15 platforms

including Android, Bada, BlackBerry 5/6/7, BlackBerry 10, Chrome,

Facebook, Firefox OS, iOS, Java ME, HTML5, OSX (desktop), Windows

(desktop), Windows Phone, Windows 8 and Tizen. As our research focuses

on mobile developers, we have excluded from the analysis all respondents

that are not developing for mobile platforms.

To minimise the sampling bias for platform distribution across our outreach

channels, we weighted the responses to derive a representative platform

distribution. We compared the distribution across a number of different

developer outreach channels and identified statistically significant channels

that exhibited the lowest variability from the platform medians across our

whole sample base. From these channels we excluded the channels of our

research partners to eliminate sampling bias due to respondents recruited

via these channels. We derived a representative platform distribution based

on independent, statistically significant channels to derive a weighted

platform distribution.

By combining the regional and platform weighting we were able to minimise

sampling biases due to these factors. All results in the report are weighted by

main platform and region.